In a market flooded with multi-asset prop firms offering everything from forex to commodities, Velotrade stands apart with a singular focus: cryptocurrency. This isn't a limitation -- it's our competitive advantage. Here's why crypto-only matters.

The Complexity Trap of Multi-Asset Firms

Many prop firms pride themselves on offering multiple asset classes. On the surface, this seems like a value-add for traders. In reality, it often leads to a jack-of-all-trades, master-of-none situation.

Each asset class has unique characteristics, regulatory requirements, and market dynamics. A firm trying to support forex, commodities, indices, and crypto simultaneously must spread its resources, expertise, and technology across all these domains. The result? Mediocre execution in all areas rather than excellence in one.

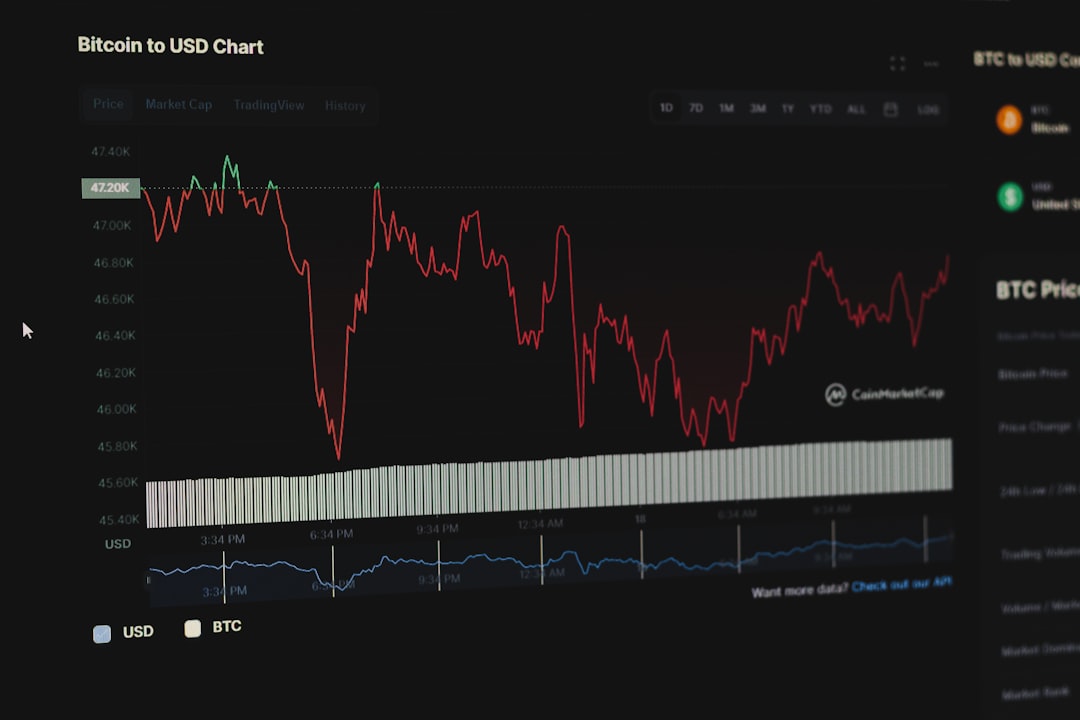

Crypto markets are fundamentally different from traditional assets. They operate 24/7, have unique volatility patterns, face different regulatory frameworks, and require specialized infrastructure for custody, execution, and risk management. A firm that treats crypto as just another asset class alongside forex or stocks is unlikely to optimize for these unique characteristics.

Higher Leverage Through Specialized Infrastructure

By focusing exclusively on crypto, we've built infrastructure specifically optimized for digital asset trading. This includes direct integrations with major crypto exchanges, specialized custody solutions, and risk management systems calibrated for crypto volatility patterns.

This specialization allows us to offer higher leverage more safely than multi-asset firms. While traditional prop firms might cap crypto leverage at lower levels due to perceived risk, our specialized systems can monitor and manage crypto-specific risks in real-time, allowing traders to access greater capital efficiency.

Our liquidity bridges connect directly to institutional crypto market makers and exchanges. We don't need to route through forex liquidity providers or adapt traditional market infrastructure -- our entire stack is built for crypto from the ground up.

Simpler Compliance and Regulatory Framework

Multi-asset firms must navigate a complex web of regulations across different jurisdictions and asset classes. Forex regulations differ from commodities regulations, which differ from securities regulations, and crypto regulations are in a category of their own.

By focusing solely on crypto, we operate within a single regulatory framework. This isn't just simpler for us -- it's better for you. We can move faster, implement new features more quickly, and provide clearer, more consistent terms of service.

It also means our compliance team is entirely focused on crypto-specific regulations. We don't need generalists who understand multiple asset classes at a surface level -- we employ specialists who deeply understand the nuances of crypto compliance, from AML requirements to custody regulations.

Faster Execution and Better Technology

Execution speed in crypto markets can mean the difference between profit and loss. With our specialized infrastructure, we achieve faster execution times than multi-asset platforms that must route crypto orders through generalized trading systems.

Our technology stack is purpose-built for crypto. We don't adapt traditional trading platforms to handle digital assets -- we've built our systems from scratch with crypto at the core. This includes websocket connections to exchanges, optimized order routing algorithms, and risk management systems that understand crypto market microstructure.

The result is measurably faster execution, tighter spreads, and better fills. In a market where milliseconds matter, this specialized technology provides a tangible edge.

Deep Crypto Market Expertise

Our team doesn't just work in crypto -- we live and breathe it. From our founders' decision to bring institutional finance expertise into the crypto space, to our risk management team's deep understanding of digital asset volatility, to our trader support staff who speak the language of crypto markets fluently, specialization runs through our entire organization.

This expertise manifests in countless ways: better risk parameters that account for crypto-specific events like exchange maintenance and token unlocks, educational resources focused on crypto trading strategies, and a support team that understands the unique challenges crypto traders face.

When you trade with a crypto-only firm, you're not just getting access to markets -- you're partnering with specialists who have invested everything in becoming the best in this specific domain. In an industry as complex and fast-moving as crypto, that specialization matters immensely.