In the high-stakes world of crypto trading, liquidation has long been the sword of Damocles hanging over every trader's head. One wrong move, one unexpected market swing, and your entire position can be wiped out in seconds. But what if there was a better way? What if institutional-grade technology could protect you from the devastating losses that have plagued retail traders for years?

The Traditional Liquidation Problem

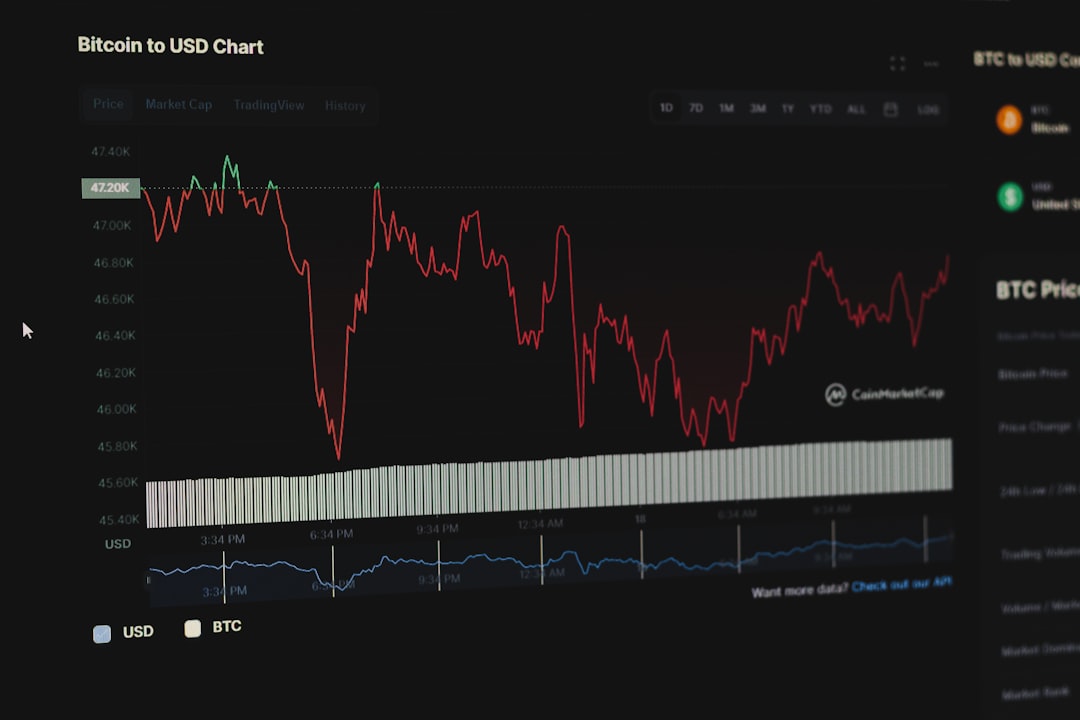

Liquidation occurs when a trader's position is forcibly closed by the exchange because they can no longer meet the margin requirements. This typically happens during periods of high volatility when the market moves against the trader's position. Traditional crypto exchanges use a simple model: once your margin falls below a certain threshold, your position is automatically liquidated, often at the worst possible prices.

The impact is devastating. According to industry data, retail traders lose billions of dollars annually to liquidations. Even experienced traders with sound strategies can find themselves caught in cascading liquidations during flash crashes or extreme volatility events.

The problem is compounded by the 24/7 nature of crypto markets. Unlike traditional markets with circuit breakers and trading halts, crypto never sleeps. A liquidation can happen at 3 AM while you're asleep, wiping out weeks or months of gains in minutes.

How Institutional Risk Management Changes Everything

Institutional traders -- think hedge funds, banks, and proprietary trading firms -- have long employed sophisticated risk management systems that go far beyond simple stop-losses. These systems use AI-driven algorithms, real-time hedging, and dynamic position sizing to protect capital even in the most volatile conditions.

At Velotrade, we've brought this institutional-grade technology to prop trading. Our risk management system doesn't just react to market movements -- it anticipates them. Using AI-driven hedging combined with institutional liquidity bridges, we can protect your positions in ways that simply weren't available to retail traders before.

The key difference is that our system views risk holistically. Instead of treating each position in isolation, we analyze portfolio-level risk, correlation between assets, and broader market conditions. This allows us to implement protective measures before liquidation becomes a concern.

The Velotrade Advantage: $2.5 Billion in Proven Experience

Since 2016, the original Velotrade team has paid out over $2 billion to clients worldwide through our invoice financing and trade finance operations. This isn't theoretical -- it's a proven track record of managing risk and delivering returns at scale.

When we entered the crypto prop trading space, we brought this institutional expertise with us. Our platform combines the battle-tested risk management frameworks from traditional finance with the speed and efficiency of crypto markets.

What does this mean for you? It means trading with up to $200,000 in capital, knowing that your positions are protected by the same risk management systems used by billion-dollar hedge funds. It means sleeping soundly even during volatile market conditions, confident that institutional-grade safeguards are monitoring your positions 24/7.

Trader-First Rules: Transparency in Risk Management

One of the biggest frustrations traders face with traditional prop firms is hidden risk management rules. Consistency requirements, trailing drawdowns, and forced closures create a minefield of potential violations that traders only discover after it's too late.

We believe in transparency. At Velotrade, all our risk management rules are published upfront. No hidden trailing drawdowns. No consistency traps. No weekend forced closures. What you see is what you get.

This transparency extends to our profit-sharing model. You keep 80% of your profits -- period. No complicated tier systems, no performance fees that eat into your earnings. Our institutional hedging model means we make money when you make money, creating a true partnership where both parties are aligned.

The Future of Prop Trading is Here

The crypto prop trading industry is at an inflection point. The old model -- high liquidation risk, opaque rules, and adversarial relationships between firms and traders -- is giving way to a new paradigm built on institutional-grade technology, transparency, and genuine partnerships.

At Velotrade, we're leading this transformation. Our combination of proven traditional finance expertise, cutting-edge risk management technology, and trader-first philosophy represents the future of the industry.

For traders who have experienced the pain of liquidation, or who have avoided prop trading due to fear of unfair rules, we offer a better way. A way to access significant capital, trade with institutional-grade protection, and keep the majority of your profits -- all without the constant fear of liquidation that has defined crypto trading for too long.

The future of crypto prop trading isn't about eliminating risk -- it's about managing it intelligently. And with institutional-grade systems now accessible to individual traders, that future is already here.