What Are Funding Ticks? Why Precision Matters in Crypto Prop Trading

In the world of professional proprietary trading, the difference between a profitable month and a failed challenge often comes down to the smallest unit of price movement: the tick.

For retail traders moving to a funded account, understanding "funding ticks", or more accurately, the quality of tick data provided by your prop firm, is the secret weapon for surviving high-volatility crypto markets.

The Hidden Risk: Aggregated vs. Tick-by-Tick Data

Most retail brokers feed you "aggregated" price data. They smooth out the noise. But in a crypto prop firm environment, "noise" is where the opportunity (and the danger) lives.

Funding ticks refer to the raw, unadulterated stream of price updates that a firm uses to:

- Trigger stop losses

- Calculate drawdown limits

- Execute market orders

Why "Ticks" Kill Funded Accounts

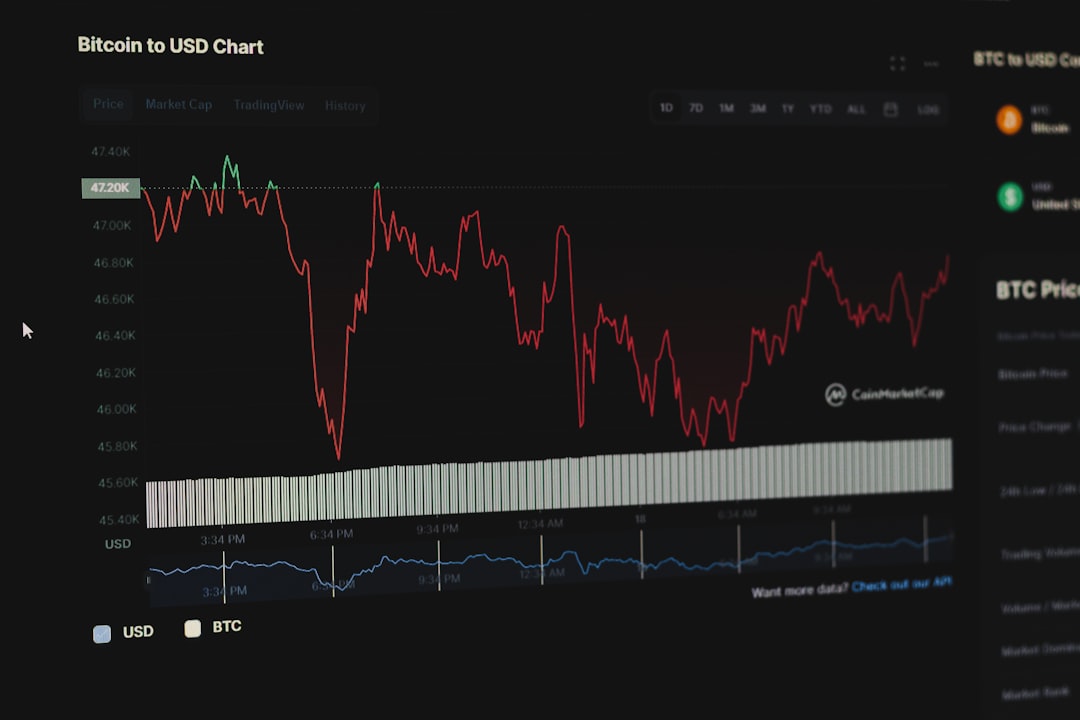

Imagine Bitcoin drops from $65,000 to $64,900 in one second.

- Aggregated Feed: Shows the open and close.

- Tick Feed: Shows the wick that dipped to $64,850.

If your stop loss was at $64,875, a low-quality feed might save you. But a true institutional prop firm account uses precision ticks. If you aren't trading with this granular visibility, you are trading blind.

Velotrade's Approach to Funding Availability

At Velotrade, we believe in radical transparency. Our crypto trading engine is built on institutional-grade connectivity.

1. No "Phantom" Wicks

We don't manipulate feeds to hunt stops. What you see on the chart is what executed over the wire.

2. High-Frequency Friendly

Scalpers need to see every tick. Our infrastructure supports high-frequency strategies that rely on capturing micro-movements (funding ticks) that others miss.

3. Execution Quality

When you trading with up to $200,000 of firm capital, execution speed is paramount. We minimize the latency between the "tick" arriving and your order filling.

How to use Tick Data to Win Your Challenge

- Backtest with Tick Data: Don't rely on 1-minute close data. Use tick data to stress-test your strategy against slippage.

- Watch the Spread: In crypto, spreads widen during volatility. Tick charts show you the "true" spread in real-time.

- Choose the Right Firm: Avoid firms that use "simulated" ticks that don't match live market conditions.

Conclusion

Ignorance of funding ticks is a leak in your trading edge. By switching to a firm that prioritizes data integrity, you protect your funded account from unfair slippage and execution games.

Ready to trade with precision? Start your challenge today and experience the Velotrade difference.