Invoice Elements For Financing - Beyond The Basics

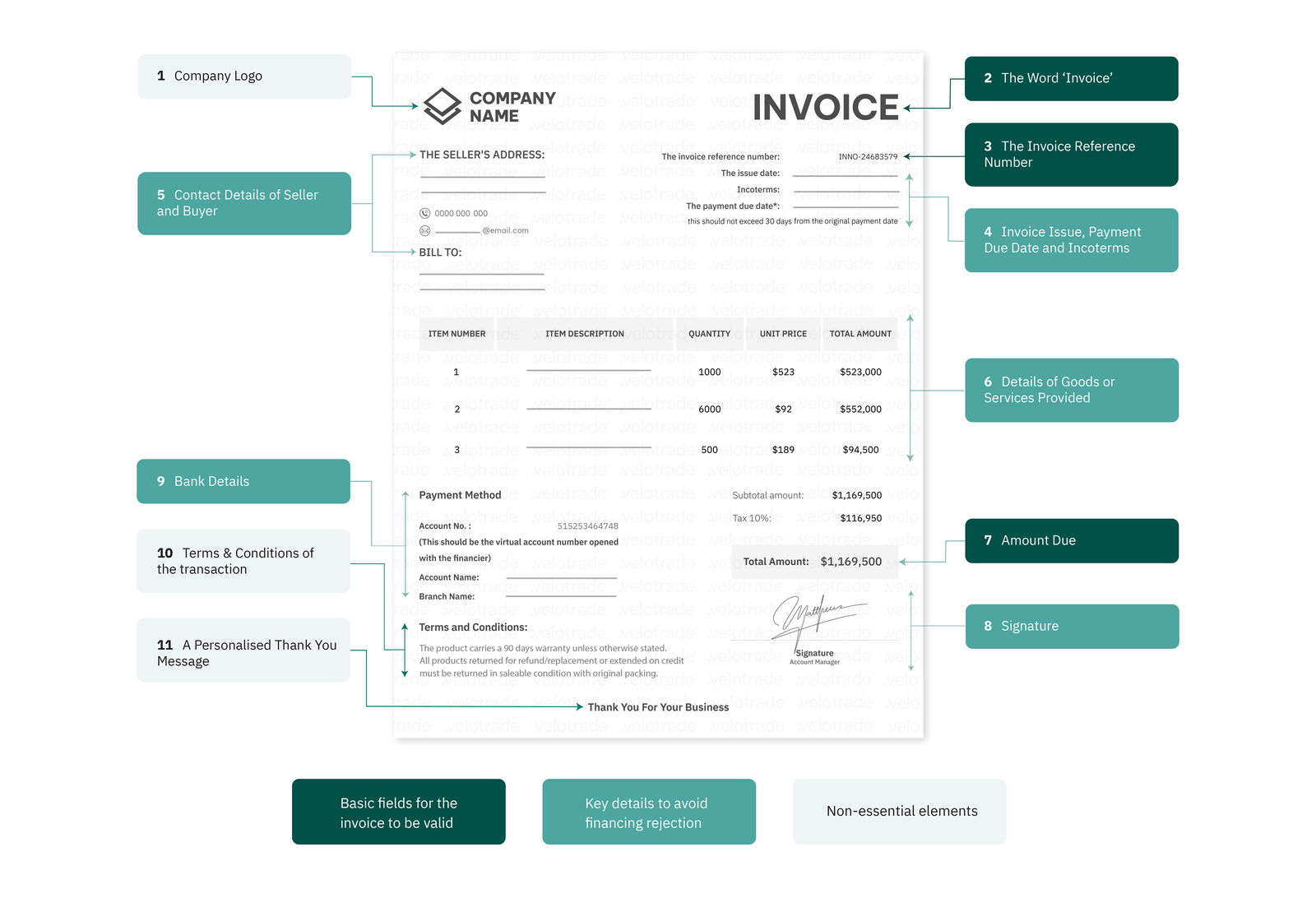

An invoice is a timesensitive document issued by the seller to the buyer as a formal request for payment.

You are viewing Velotrade in early access. The full platform is launching soon. Join the waitlist

Browse 48 legacy articles from Velotrade.

An invoice is a timesensitive document issued by the seller to the buyer as a formal request for payment.

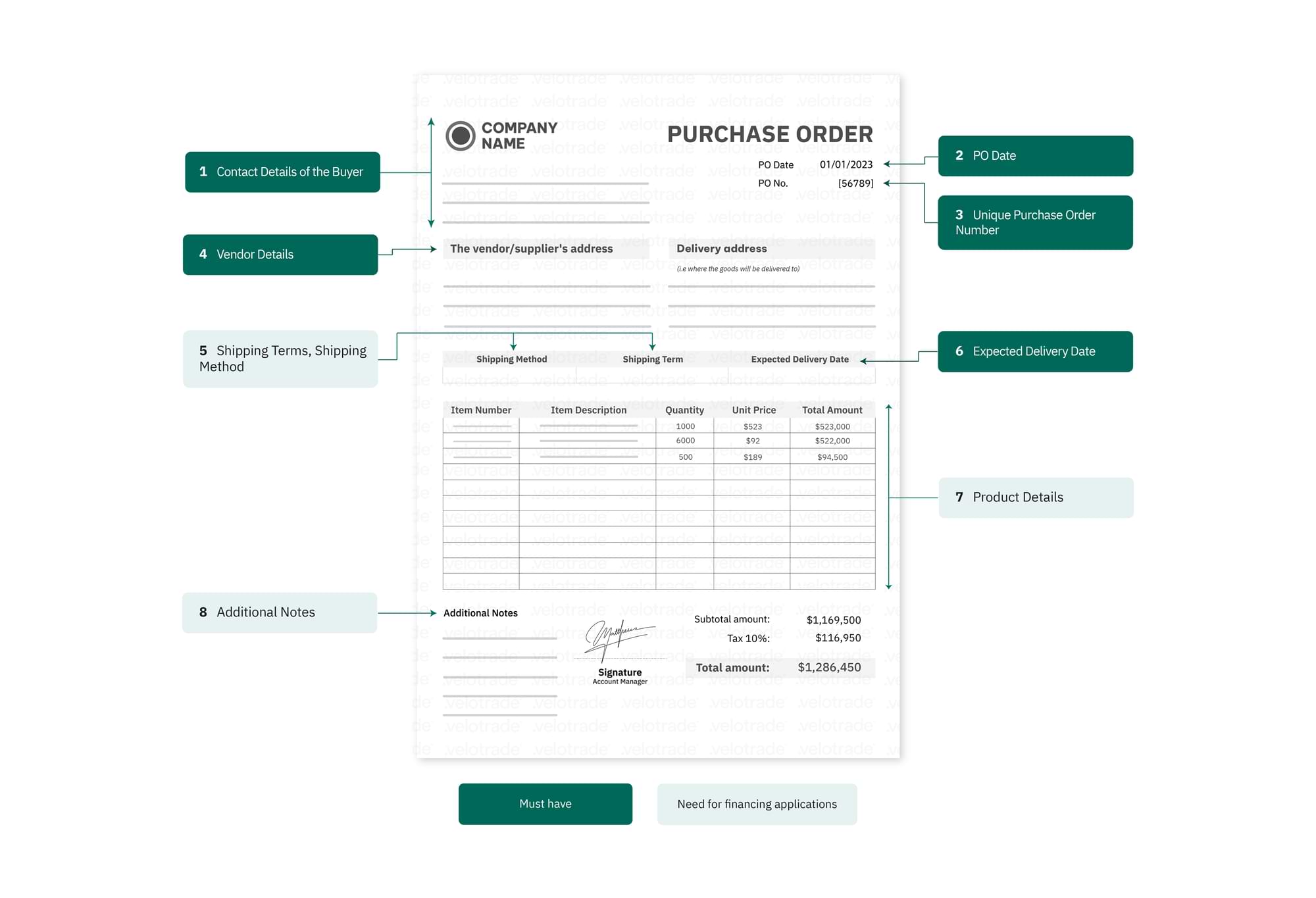

A purchase order (PO) is an official document issued by a buyer detailing the goods or materials to be purchased by the seller. It’s a green light for the seller to provide the ...

Cash flow is the net amount of cash or cash equivalent moved in and out of a business over a specific period.

Vietnam’s tightening credit market has impacted SMEs and corporates from various industries. While the market has been experiencing a significant funding shortage, the governmen...

More than ever, strategic allocation of the advertising budget is a key to business development. Not only has digital marketing proven to be a critical pivot to eCommerce, but t...

Governments have spent massively for the Covid19 pandemic – but to truly rebuild consumer confidence, much more must still be done.

Receivables financing is when a business transforms its outstanding accounts receivables (AR) into cash via a financing facility using the receivables as collateral. These recei...

Last update:

Any business operation follows a cyclical pattern for its ventures.