Governments have spent massively for the Covid-19 pandemic – but to truly rebuild consumer confidence, much more must still be done.

To kickstart the economy requires a global effort from the Governments and an immense amount of hard work by a new generation of finance industry players.

Highlights of this article

- Government Policies and Initiatives for Economic Recovery Know the measures taken in 3 major economic regions

- The Role of Trade Finance How Trade Finance solutions provide financial support to manufacturers

In recent months, the flow of goods across international borders has slowed significantly. The ICC is forecasting a decrease in global trade by up to 30 per cent.

Currently, 200 million businesses need financing to invest, grow and create new jobs. These SMEs account for 9 out of 10 companies, half of the global GDP, and two-thirds of jobs worldwide, as per Matt Gamser – SME Finance CEO of the IFC (International Finance Corporation).

SMEs Struggle to Access Credit

Many SME manufacturers are facing severe difficulties in staying afloat. The cause is due to a dramatic order shortfall and limited financial reserves.

Due to the increasing systematic risk, banks are narrowing the amount of credit offered to small businesses. Likewise, private credit insurers are withdrawing support for specific sectors or increasing premiums.

Although central banks have acted swiftly to cut interest rates, SMEs are struggling to raise new funds. For this reason, newer Fintech players are making a significant contribution to plug this market gap. However, FinTech companies still lack the scale to address the overwhelming challenge.

To address the issues mentioned above and kickstart the economy, the ICC has called for 5 trillion dollars in trade credit. Through this manoeuvre, ICC helps SMEs to scale up and meet the post-coronavirus demand.

Governments Measures to Kickstart the Economy

Governments have already introduced incentives in many countries to kickstart the economy. Those bits of help will cushion businesses and consumers from the economic impact of Covid-19.

However, a closer look at recent budget allocations indicates that SMEs involved in international trade will only receive limited benefits. Consequently, more focused budget allocation is still required, as the following analysis shows:

Europe

A Recovery Fund has been established to support sectors most affected by the pandemic. A total of 750 billion euros in grants and loans is immediately available. A further trillion euros is to be released between 2021 and 2027.

Earlier, the ECB issued a stimulus package of 540 billion euros and programmed to purchase government bonds valued at 1.35 trillion Euros.

USA

The US government has arranged a massive injection of liquidity into the financial system.

An estimated 3 trillion dollars has been allocated to save millions of jobs and more than 500 billion to small businesses in the form of forgivable loans.

Likewise, consumers receive 1,200 dollars each. If they become victims of the current economic crisis, they could access another 600 dollars in benefits.

Asia

China has made several financial policy interventions to support economic recovery.

It combines 4 trillion RMB (600 billion USD) in tax exemptions for factories and retailers. Also, it includes waiving contributions to social welfare funds. Besides, banks have already cut interests rates and utility costs.

Further fiscal policy easing consists of the issuing of an additional 3.75 trillion of local government debt. Moreover, the China Government will issue 1 trillion RMB of special treasury bonds.

Hong Kong has also approved anti-epidemic measures including subsidies for industries such as retail, food, transport, travel, exhibitions and conferences. The government has instructed all banks to grant a six month repayment holiday on loans to SMEs. It allocates 6 billion HKD to create some 30,000 time-limited jobs in both the private and public sectors.

As part of this activity, the FAST programme provides a budget of HKD 120 million to the FinTech sector. It aims to support the creation of up to 1,000 new jobs. Hong Kong Cyberport Management Company runs the FAST programme.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Find out how covid impacted global markets under 3 recovery scenarios.

Why Trade Finance is Key

As we see, governments have extended a great deal of market liquidity. These stimulus support consumers at risk of losing their jobs and businesses that need to replace regular revenue to stay afloat. The result is a level of equilibrium in each domestic economy, but this does little to support international trade.

This approach has left the global trade sector without a solid financial base to kickstart the economy and international trade post the crisis.

In response, Fintech players are stepping up with alternative financing solutions so that SMEs in the import and export industry can access the funding required.

Sophisticated Supply Chain

As we all know, consumers and businesses alike depend on the import of a wide range of goods to support the modern lifestyle. In many societies, these products are imported from countries with a lower manufacturing cost.

A sophisticated supply chain evolved through the years to support a modern lifestyle. It delivers goods from the factory door to shops and homes.

It usually takes a considerable timespan – 90-120 days or more – from order placement and production to final delivery.

During this period, each order requires financing with working capital. The funding covers the cost of raw materials, manufacturing, workforce and shipping.

The five trillion dollar funding proposed by the ICC is necessary to reboot global trade following today’s drastic slowdown.

Not only did consumers and businesses stop spending. The knock of effect from this economic disaster was the delay on many international deliveries.

SME funding is at an all-time low. Asian manufacturers need financial support more urgently than ever. Financing allows factories to meet new orders that arrive to meet post-COVID market demand.

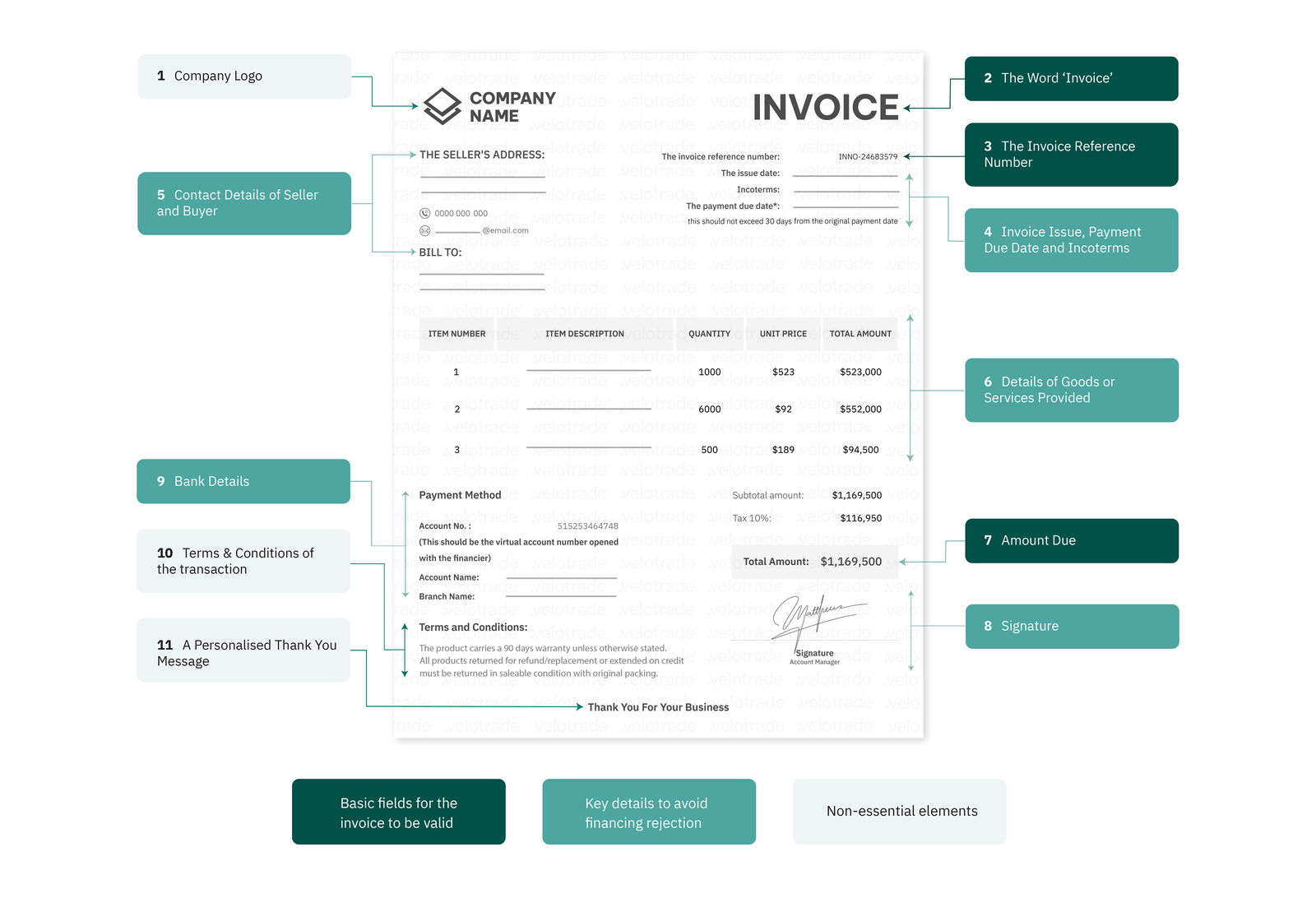

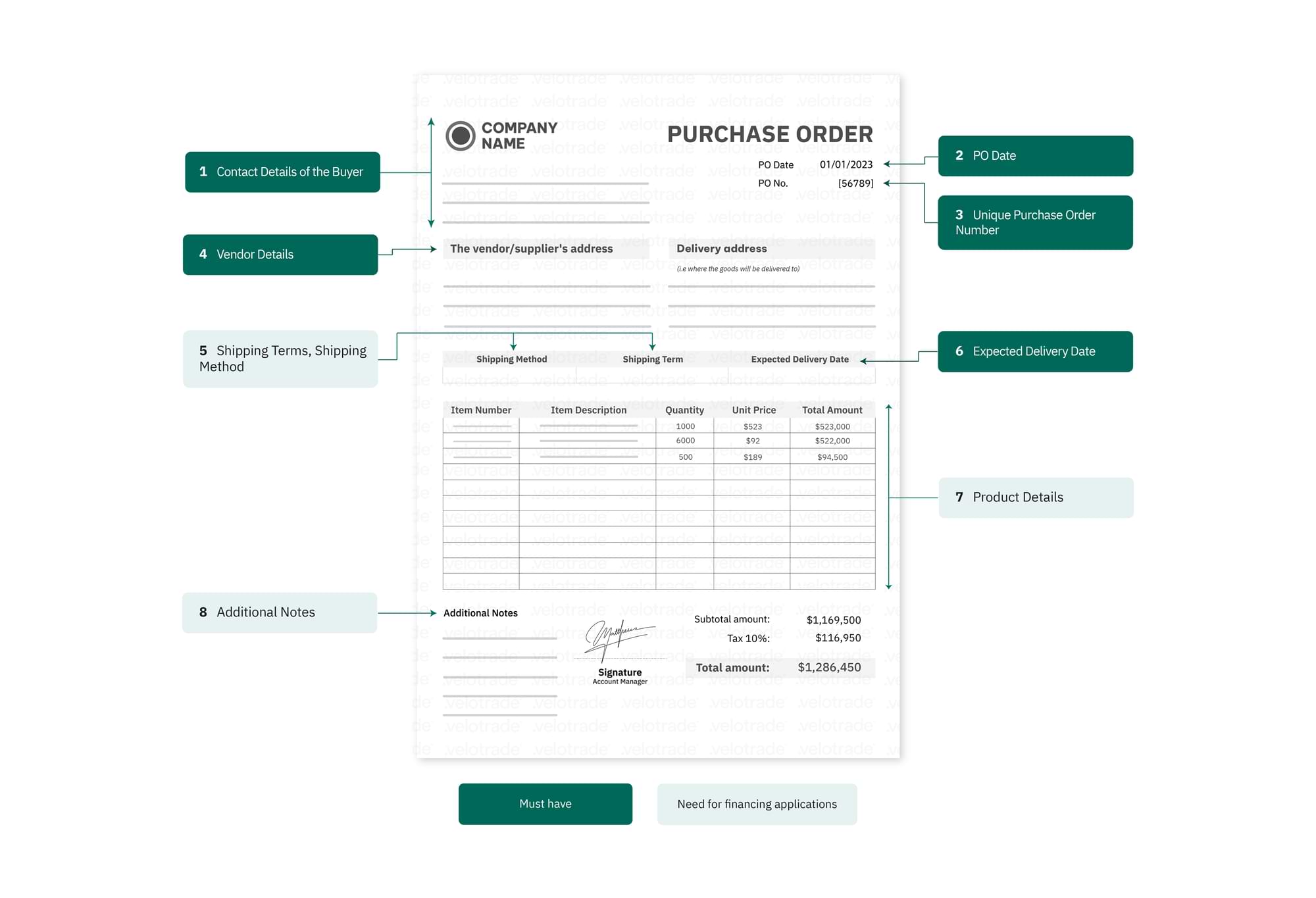

New funding can be used to activate international trade in a relatively straightforward manner. Market-based solutions already exist. The key to financing an export trade order is in the invoice itself.

Alternative Source of Funding

Once a manufacturer issues an invoice to his customer, it carries an intrinsic value that can be used to obtain credit. This credit line serves as working capital allowing the supplier to source raw materials, manage production and ship products. It also allows the supplier to cover all operational expenses. This effectively fills the gap until the invoice is finally settled according to pre-agreed contractual commitments.

Nations grapple with Covid-19 and gradually bring the pandemic under control. With the above measurements, the economy will kickstart and the demand for a resumption of international trade will rise in volume.

For Governments, Export Credit Guarantee Schemes, Banks and other institutions that want to contribute to this vital process, supply chain financing via online platforms offer the most effective tool to meet this vast and significant market need.

For this reason, a platform like Velotrade comes into its own by directly financing SME invoices. Have a look at the different trade finance solutions that we offer.