Cash flow is the net amount of cash or cash equivalent moved in and out of a business over a specific period.

Cash equivalents include short-term securities that mature within 90 days or less.

Monitoring and reviewing cash flow helps businesses in financial planning, coping with necessary expenses, and preparing for future quarters and economic downturns.

Highlights of this article

- What do Positive and Negative Cash Flow Mean For Your Business? Know the difference with examples to better understand the meaning

- Is Profit and Positive Cash Flow the Same? Find out how firms can be unprofitable while having a positive cash flow

- What are the 3 Types of Cash Flow Activities? Examples of Operating, Investing, and Financing activities

- Why is Accurate Cash Flow Analysis Important? Unlock the 3 key steps to an effective cash flow analysis

Cash flow can be categorised as:

Cash Inflows

Cash Inflow is money coming into a business through any source of income generated by the company.

The most common Cash Inflow entries on the balance sheet are:

- Income from the sale of goods or services

- Returns on investment in trade finance assets, stocks, property, or equipment

- Capital from funding and financing activities

Cash Outflows

Cash Outflow is money leaving the business due to any form of expenses, debts, or liabilities.

The most common Cash Outflow items found on the balance sheet include:

- Salaries payments to employees and management

- Procurement of goods or equipment, e.g. a computer company paying $150 million for outsourced microprocessors

- Loans provided to other businesses

- Dividend payments to shareholders

Net Cash Flow

Net cash flow is the difference between cash inflow and outflow, either positive or negative.

Positive vs Negative Cash Flow

A company’s cash flow can be positive or negative depending on it cash outflows and inflows.

It is important for businesses to understand the impact of positive and negative cash flows to determine and analyse cash flow forecasts thoroughly.

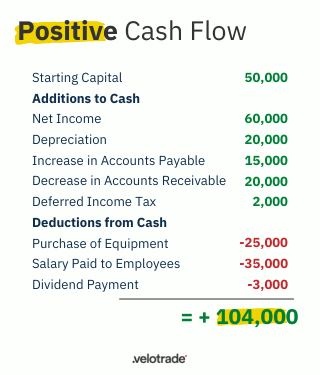

Positive Cash Flow

A company has a positive cash flow if the cash inflow is greater than its cash outflow. Thus, the business has enough liquidity (cash) to pay the expenses.

For example, a business starts with $50,000 in cash.

It incurs $63,000 in expenses, but $117,000 of cash inflow enters the business (from various sources).

The net cash flow is positive at (50,000 + 117,000) – 63,000 = $104,000

Refer to the illustration below for a better understanding of the flow.

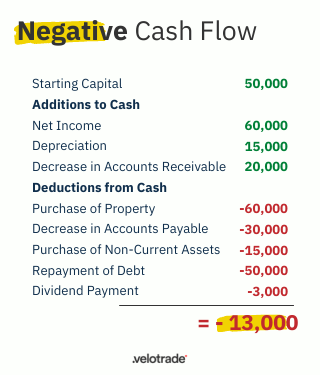

Negative Cash Flow

In contrast, negative cash flow is when cash outflow exceeds cash inflow.

Negative cash flow stalls the business from paying for current and future expenses.

For example, a business starts with $50,000

Cash inflow is $95,000 but cash outflow is $158,000.

The balance of -$13,000 is calculated as [(50,000 + 95,000) – (158,000).

Thus, the company’s net cash flow is negative.

Check the illustration below for a calculation breakdown.

Yet, not all negative cash flows are bad.

For example, when investing in fixed or non-current assets, the company does not receive proceeds immediately.

Cash outflow today can help companies gain a greater cash inflow in the future, making the negative cash balance a sign of future revenue.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Wondering how the above elements impact cash positively or negatively? Know what is cash flow statement to find out how!

Positive Cash Flow vs Profit

Although the two measures may appear very similar, they are highly distinctive from each other.

Profit is the revenue remaining after all expenses have been deducted. Conversely, positive cash flow is when a company has more monies coming in than going out.

Companies can have positive cash flow while being unprofitable.

Likewise, a business can experience negative cash flow but still be profitable.

The difference lies in the recognition period.

While revenues and expenses are recognised at the time the payment is made, profit is recorded on an accrual basis i.e. at the time the transaction occurs, regardless of when payment is made.

To sum up, the key difference between the two is time.

Profit can tell you how much money a business has made over a period of time. However it does not tell you whether all the money was received during that same period.

Thus, it is not a true indicator of the financial success of a business as you do not know when the cash inflow and outflow happened.

If a business is unprofitable and cash flow positive, it may have a hard time remaining cash flow positive for too long.

Hence, businesses should monitor their cycle of cash inflow and outflow to identify their source of losses and true liquidity position.

What are the 3 Types of Cash Flow?

Cash flow activities are classified into three categories:

Operating Activities

Operating activities are revenues and expenses generated by a company’s core business that relate to its net income or loss, such as:

CASH INFLOW

CASH OUTFLOW

Revenue generated from goods sold or services provided (e.g. a manufacturer sold products to its retailer)

Payment made to suppliers

Cash receipts from royalties (e.g. authors grant publishers the right to sell and distribute their books, and receive book royalties by publishers)

Salary payment to employees

Earnings from commission or other service charges

Income tax payment

Depreciation and amortization of property and equipment

Investing Activities

This section includes investment and expenditure activities to generate future cash inflows, such as:

CASH INFLOW

CASH OUTFLOW

Sale of marketable securities and investment or fixed assets

Purchase of fixed assets like land, property, furniture, machinery etc

Cash receipts from loans provided to 3rd parties

Long-term investments in equities, bond, or debt instruments

Financing Activities

This measures cash flows between a firm and its owners and creditors. It is an attractive factor for investors to know the source and frequency of capital raised by the company.

CASH INFLOW

CASH OUTFLOW

Proceeds from debt or mortgage issuances

Repayments of debt and borrowed cash

Proceeds from issuance of common stock, or bonds

Repurchase of stock

Funds received from financing activities, such as cash advances

Dividend payments

Upon knowing the 3 types of cash flow activities, a company can determine its free cash flow.

Free Cash Flow – The True Cash Value on Hand

A company’s free cash flow is the net balance of cash after operating expenses, reinvestment, tax, interest, and non-cash adjustments have been settled.

For this reason, free cash flow is the true amount of cash a business has available on hand for use.

Here is how you calculate it:

Free Cash Flow = Cash Flow from Operations – Capital Expenditures

It starts with operating cash flow because this is a firm’s cash purely coming in from its core business activities. This extra cash could theoretically be viewed as money that could be distributed to shareholders.

Companies with surging free cash flow tend to have a higher share value. This extra cash gives them greater abilities to expand, innovate, and grow to larger scales. Investors value this and thus consider it an important metric to measure a firm’s financial health.

Thus, this financial metric indicates the financial health of a company in its truest sense.

![]() Key Takeaways

Key Takeaways

- Not All Negative Cash Flows Are Bad Cash outflow today can generate a significant cash inflow in future, making the negative cash balance a sign of future revenue.

- Companies Can Have Positive Cash Flow While Being Unprofitable While revenues and expenses are recognised at the time the payment is made, profit is recorded at the time the transaction occurs.

- **Cash Flow Comes From 3 Key Activities: Operating, Investing, and Financing **When investing in fixed or non-current assets, the company does not receive proceed immediately.

Importance of Cash Flow Analysis

Without a doubt, cash is the lifeline of any business and monitoring its movement is crucial to its survival.

But, how would you run a business successfully without knowing the source of the revenues and expenditures incurred?

Cash flow analysis tells you just that!

By knowing the source of inflows and outflows, companies have a better overview of their financial health.

This allows them to perform and enhance cash management, ensuring the business has enough money to sustain and grow operations.

Although an effective cash flow analysis involves various facets, metrics, and perspectives, below are 3 key steps:

- Prepare a cash flow statement highlighting the 3 business activities: operating, investing, and financing. Any changes in assets, liabilities, and equity can be calculated from the statement. The source and time of cash outflows, inflows, and cash withheld can then be determined.

- Measure and analyse company performance. Compare profit to net cash flow to learn your company’s true financial capability. For instance, Company X just started their business and earned $200 in revenue this year. $120 was spent on expenses. Now, you may say that they have made a profit of $80. However, out of the $200, they only collected $180 this year. Also, only $110 was paid. Hence, the company’s net cash flow is $70. Thus, this helps you know the true amount of cash your company has on hand.

- Forecast future cash flows. Net cash flow and its sources signal shortfalls and opportunities for your business. Through this, you can perform accurate budgeting and financial planning.

At its essence, cash flow analysis enables companies to perform & enhance cash management. Accurate cash flow analysis can help businesses mitigate the many common cash flow problems.

The main idea is to plan, manage, control, and optimise cash levels. Idle cash can then be invested in other opportunities.

However, businesses must establish solid strategies to manage cash flow to prepare for economic uncertainties.

Financing with Velotrade

All-online Collateral-free Flexible Transparent

Velotrade finances corporate’s operations swiftly and asks for no collaterals. Explore Velotrade trading platform