eCommerce financing is a funding solution that provides business loans to web-based merchants (eShops).

eCommerce lending helps online sellers grow, cover marketing expenses and increase sales.

Here is all you need to know to get started or grow your business with eCommerce financing.

Highlights of this article

- 3 Key Benefits to Online Sellers How eCommerce financing closes the payment gap

- Process Flow Discover important variables assessed by the financier to pass a credit check

- Efficient Funding Through API integration Understand the transaction flow among involved parties

- eCommerce Financing Application Know the eligibility criteria and maximum loan cycle length

Participants In eCommerce Financing

The eCommerce financing process involves three parties:

- The Online Seller – the applicant requesting financing. This could be a trading firm, a manufacturing company or a service provider.

- The eCommerce Marketplace Platform – a worldwide & well-known digital platform selling goods. For example, eBay, Amazon or Alibaba. They often have a warehouse to store goods.

- The Financing Platform – a reputable financial lending institution providing liquidity by advancing funds to the online seller.

Why do Online Sellers Need eCommerce Financing?

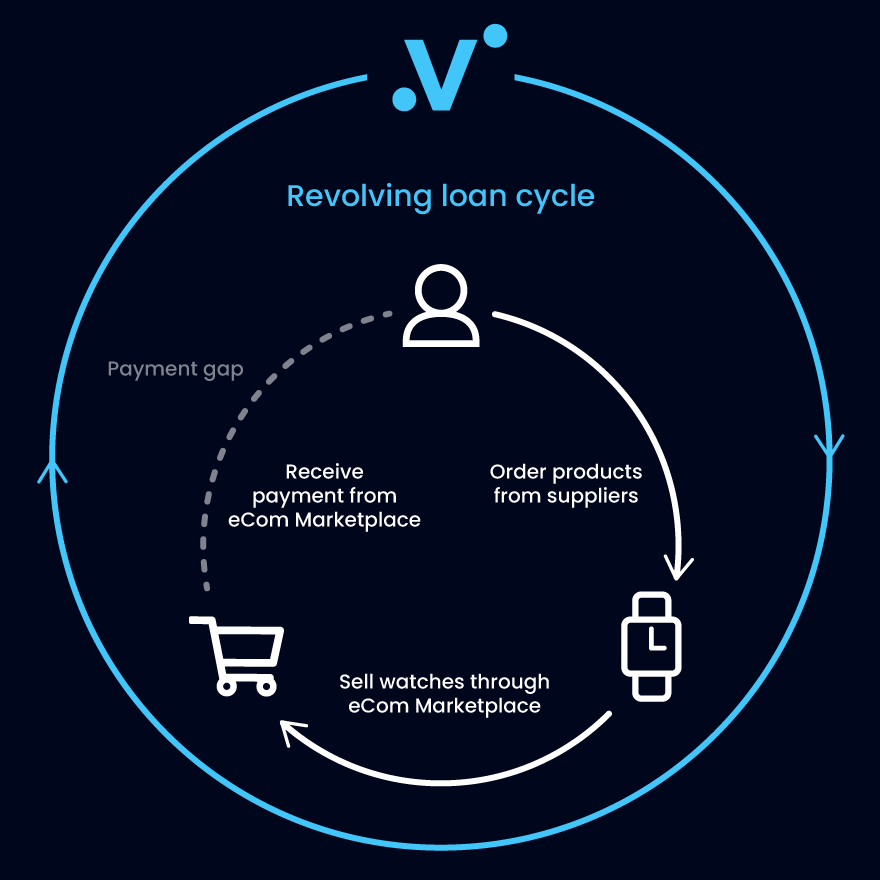

eCommerce businesses have long and irregular cash cycles and banks are usually unwilling to lend to such firms.

Marketplaces like Amazon usually pay the online sellers on a 14-day cycle. Many of these online sellers pay back their suppliers 30 or 60 days after inventory purchase.

This puts pressure on cash flow, extending the cash cycle.

Cash flow issues on the balance sheet are why most eShops apply for eCommerce financing.

Creating a new digital image of your shop can be time-consuming and costly.

Key Opinion Leaders (KOL), a.k.a influencers and content creators play an essential role in the eCommerce ecosystem and growth.

These marketing expenses take a heavy toll on your business growth.

With eCommerce financing, sellers can:

- unlock working capital to cover advertising and affiliate programme expenses, and purchase additional inventory

- close the gap between the time the revenues are generated and the time payment is made by the marketplace

- speed up their cash flow cycle

Brought to you by Velotrade, a marketplace for corporates to access financing.

Curious to know what opportunities the eCommerce market has in store for you? Unlock some eCommerce market statistics and insights!

How Does eCommerce Financing Work?

The financing company advances capital to the online seller.

The credit team of the financing company assesses the feasibility of the application. By doing so, the team performs a thorough risk analysis.

Qualitative and quantitative variables are assessed which can include:

- Yearly turnover

- Cash flow (usually the past 12 months)

- Stock analysis (flow of goods, materials management..)

- Sales performance

Upon passing credit check, the eCommerce financing platform grants a credit limit to the online seller.

Delve into an eCommerce financing case to know how we supported an e-watch manufacturer’s eCommerce cycle.

API integration in eCommerce Financing

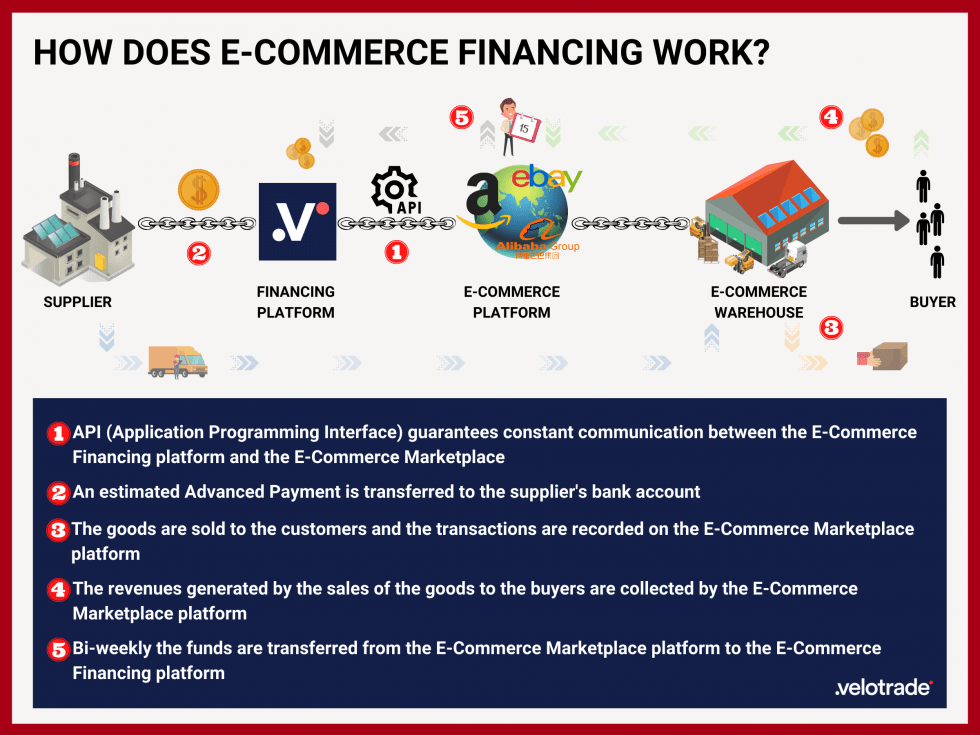

To guarantee a direct and continuous exchange of information, the API (Application Programming Interface) is set up.

API links the systems together, so the financing platform can directly transfer an advanced payment to the online seller’s bank account. The advanced payment is based on the credit allowance granted during the application.

The financing company through API accesses and monitors activities of the eCommerce marketplace platform.

This includes real-time analysis of payment records and stocks available at the warehouse.

The eCommerce platform later transfers funds directly to the financing company’s bank account as per its payout schedule.

After full repayment, the financing company’s algorithm analyses the performance of the online seller. Hence, the funding process can start again.

This dynamic renewal and transfer of funding is an entirely automated process.

With courier management, tracking, invoicing, shipment and payment records in place, businesses can coordinate and streamline their operations.

Uncover how eCommerce financing optimises different business cycles.

How to Apply for eCommerce Financing?

Firstly, your company must sell products through an eCommerce marketplace platform.

The requirements are subject to credit assessment as each company is analysed on a case-by-case basis.

Find out the eCommerce eligibility criteria by Velotrade before applying.

Once your application is approved by the credit team, Velotrade offers you funding with a 60-day repayment period on a revolving basis.

Your company can repay anytime between this 60-day period and interest will be charged accordingly.

The process is simple, free and digital.

- Register once on the Velotrade platform

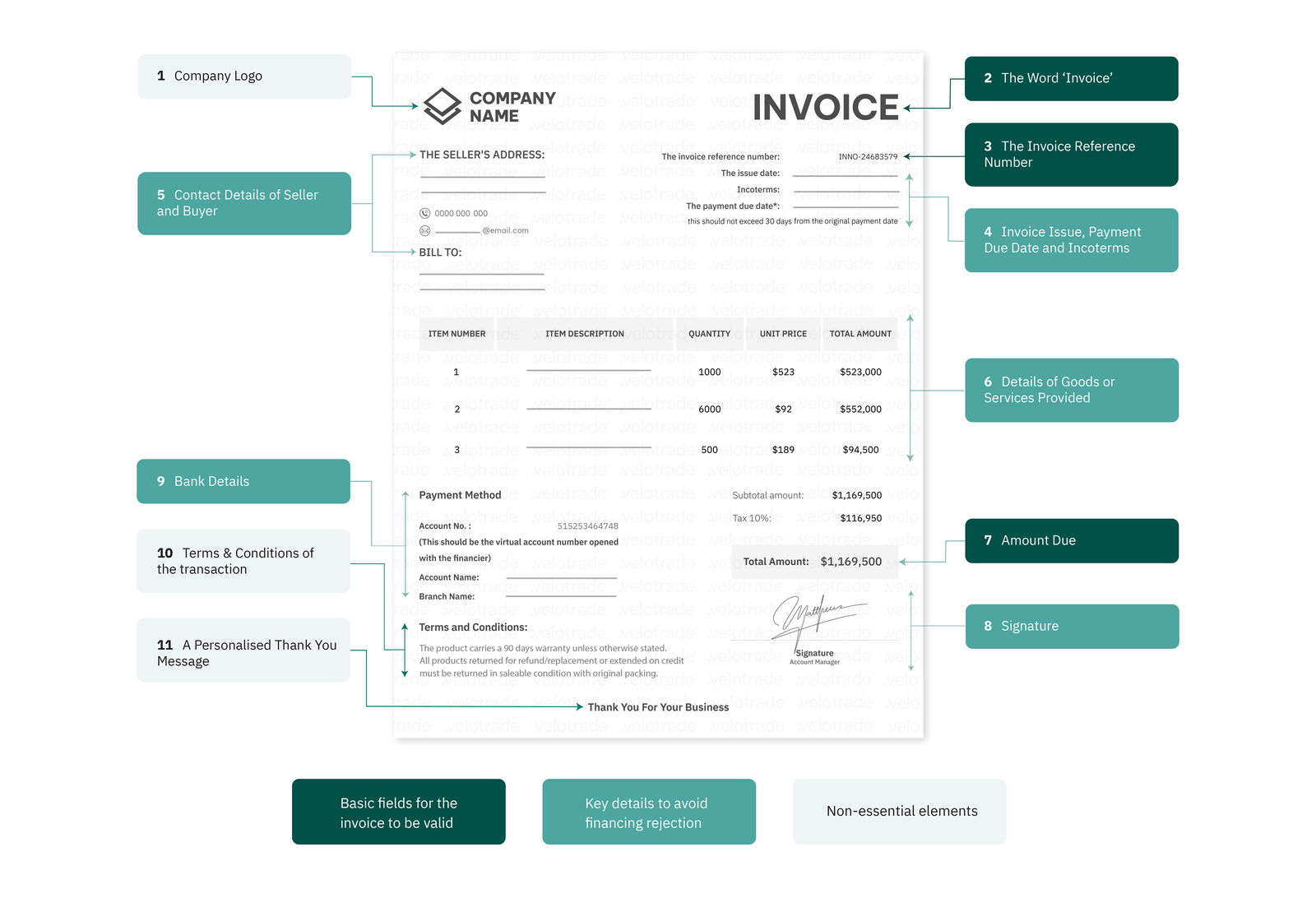

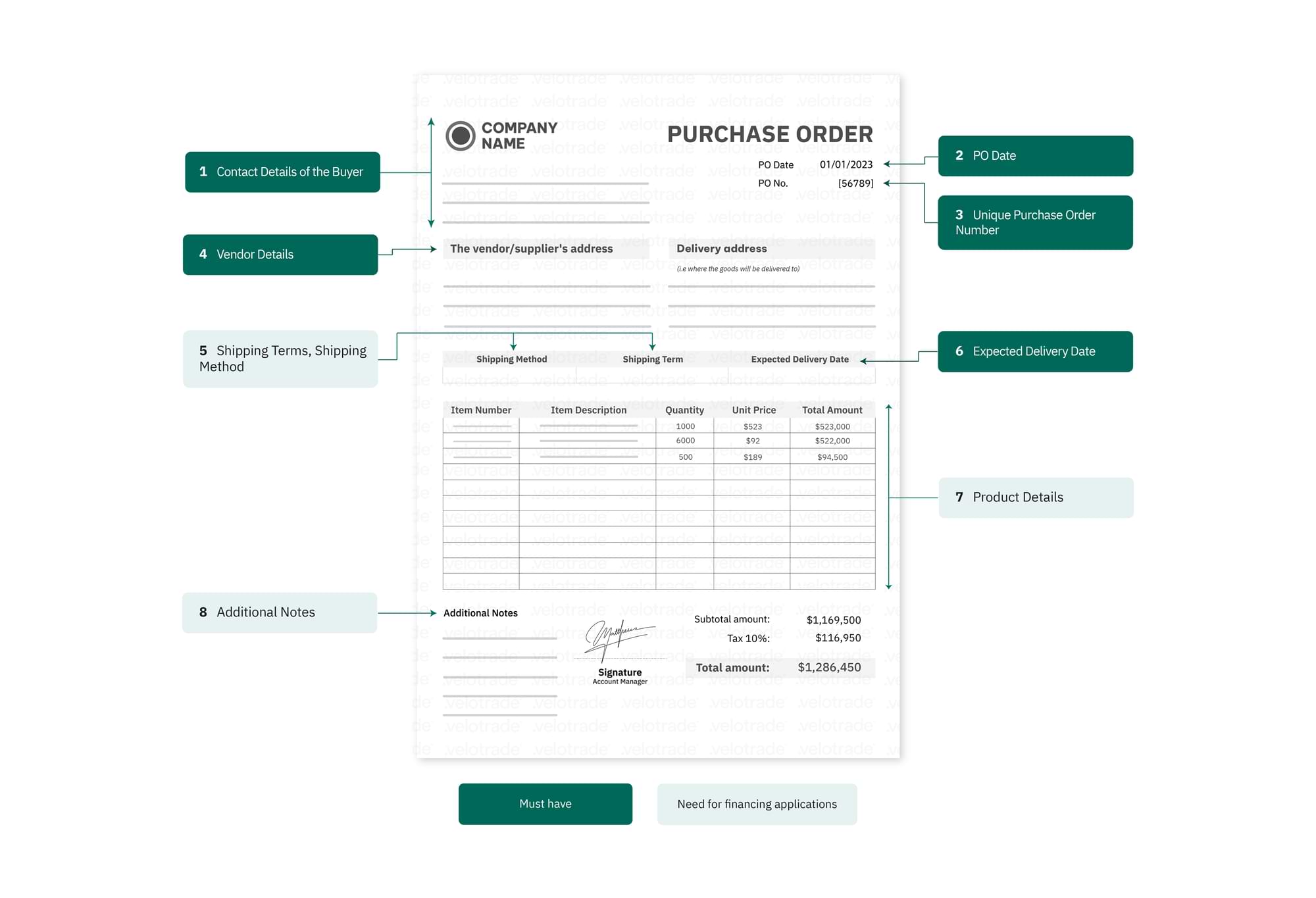

- Upload documents for verification

- Receive funds after credit approval

Get in touch with us to know details of the documentation and application process.

Scale your Online Business

Fast Scalable Digital Secured

A digital solution to optimise your digital business. See eCommerce financing options