ESG is the analysis of the ethical impact and sustainability of a venture, while sustainable financing refers to the implementation of this analysis into an investment strategy.

Sustainable finance weights sustainability factors and risks just as heavily as traditional considerations when making investment decisions.

Highlights of this article

- 3 Benefits of Sustainable Financing Sustainability for the planet, ordinary people and investors

- ESG and Trade Finance Through selective funding, trade finance could incubate more ESG propositions and sensible investing

- 2 Challenges for ESG and Trade Finance Integration Information gaps and results uniformity concerns

- What’s the future of ESG and Trade Finance? We can expect a continuance of the rising trends towards sustainable financing

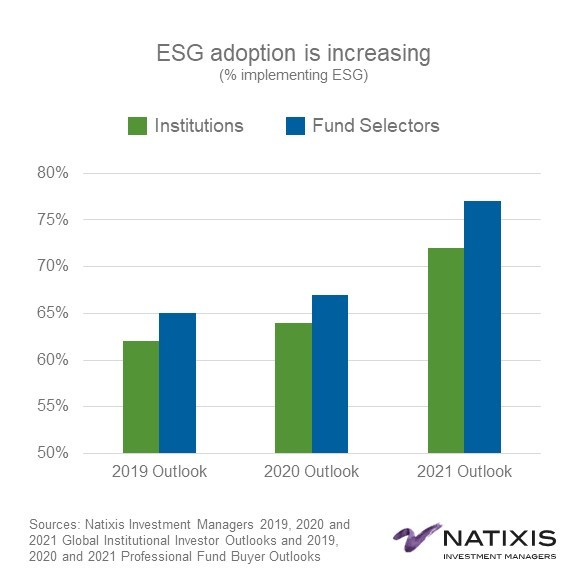

According to a study on sustainable investing conducted by Natixis, the number of professional investors implementing ESG into their portfolios has grown by 18% since 2018.

The survey also said that 77% of professional fund selectors and 75% of institutional investors considered ESG factors as cornerstones of a modern investment strategy.

As such, forecasts predicting the adoption of ESG and sustainable financing will typically show a rising trend of investor consideration in this area.

Some examples of institutions involved in sustainable finance include KPMG, HSBC, Goldman Sachs and many more.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Still unclear what is ESG? Know what are ESG factors and how they add value to businesses through this fundamental article.

Why is Sustainable Finance Important?

The importance of sustainable finance is three-fold:

Good for The Planet

Methane and carbon dioxide levels in Earth’s atmosphere are at historic highs. Arctic ice is melting at a faster rate than ever recorded. Sea levels and oceanic temperatures have never been higher. The responsibility for these shocking statistics does not predominantly lie with governments or ordinary people, it lies with businesses.

Carbon Majors Report indicates that one hundred companies are responsible for more than 70% of global emissions.

With a staggering majority of net environmental damage coming from industry, businesses can choose to either save the planet or destroy it.

Benefits for Ordinary People

The social and governance parameters of ESG directly affect anyone that interacts with your business both internally or externally. Customers, suppliers, and employees will all be positively impacted by strong ESG values.

Positive interactions translate into a better reputation, which in turn, help businesses grow and thrive. Good employee interaction increases talent retention. Good customer relationships increase customer retention.

These practises benefit everyone, including the business implementing them.

Benefits for Investors

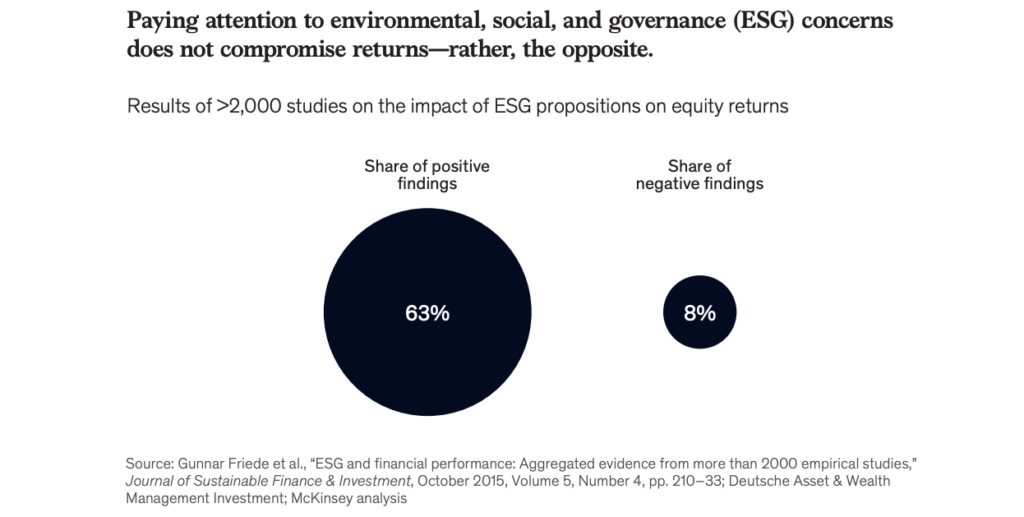

Economically it would make sense that ESG focused assets would tend to underperform when compared to their less sustainable counterparts.

However, research seems to suggest the opposite.

A 2019 study shows that ESG propositions on equity returns yielded more than eight times as many positive impact findings as negative ones.

ESG investing is therefore becoming a common strategy for investors to gain higher returns while contributing towards a sustainable ecosystem.

How Does ESG Fit into Trade Finance?

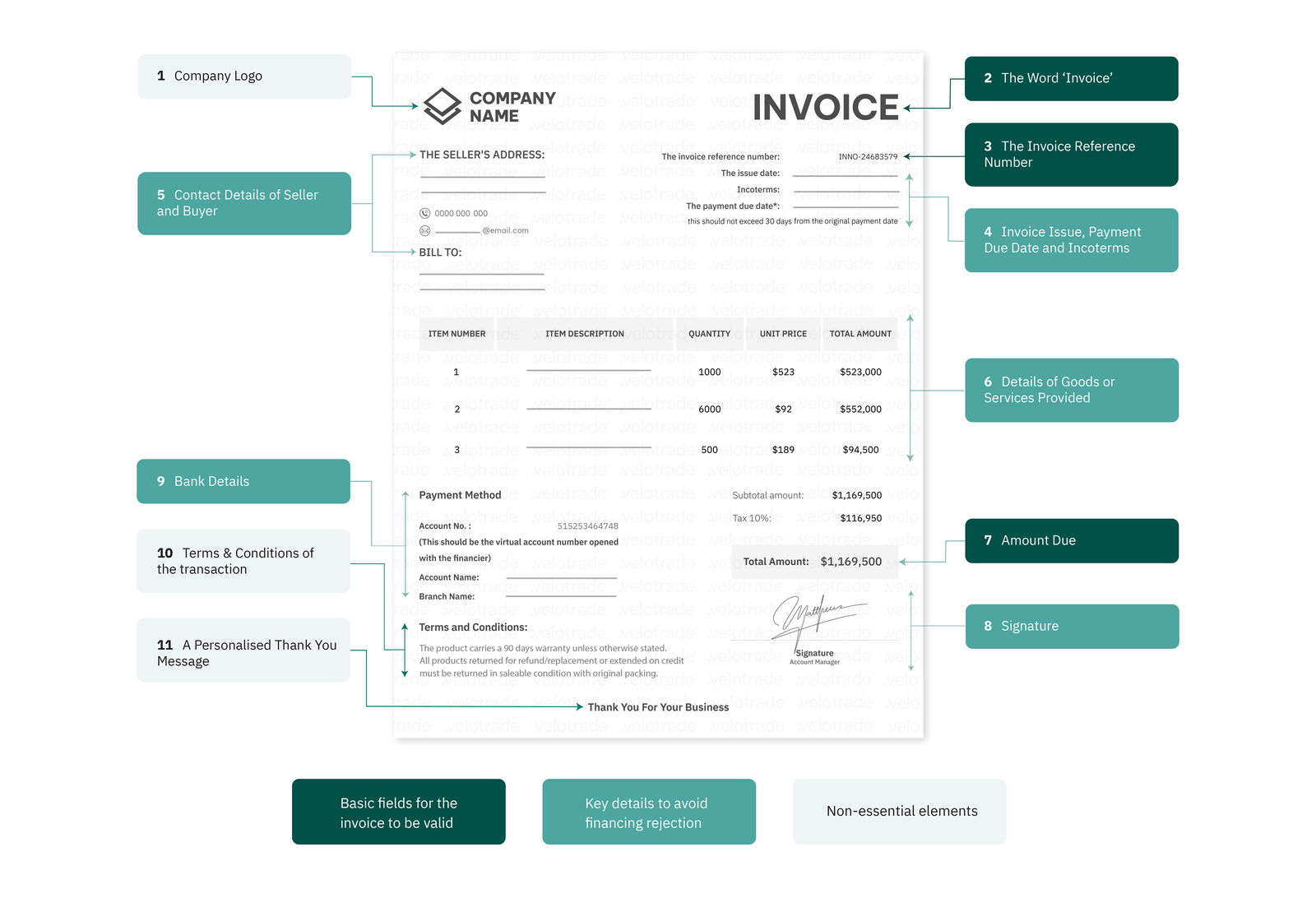

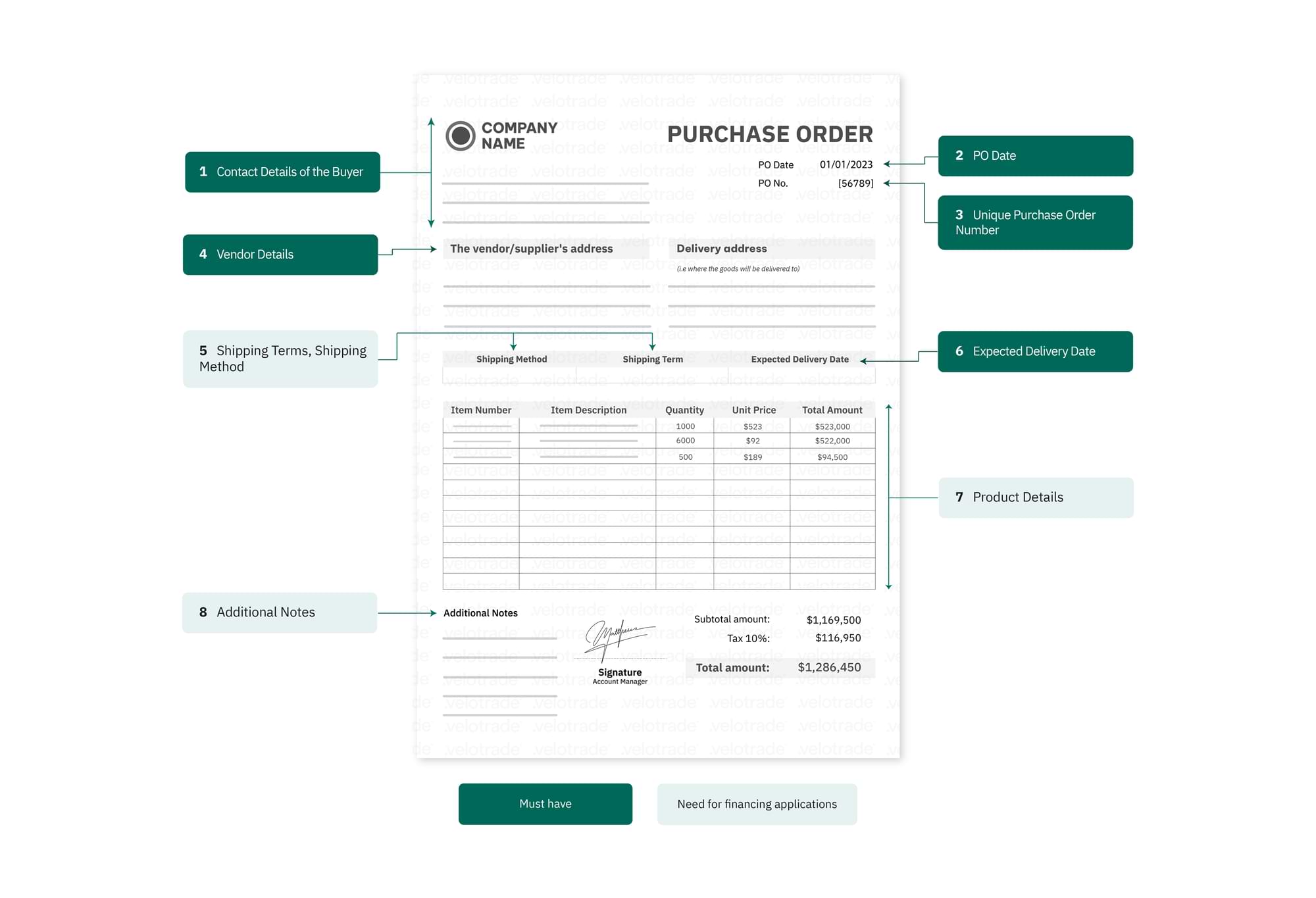

Trade finance has been used for thousands of years to incubate businesses and drive trade. It does this by bridging the gap between exporters (who prefer to be invoiced on shipment) and importers (who prefer to be invoiced on receipt).

According to trade finance global, over 80-90% of global trade is covered by credit. However, large provision gaps still exist. This is because many companies lack the resources to create significant growth or in this case, significant change.

Financial institutions have a huge role to play to help support the transition, providing financing to sustainable industries and helping investors move capital towards investments that deliver measurable ESG benefits.

Velotrade implements ESG to create a sustainable trade finance ecosystem.

A report on Trade Finance and SMEs by The World Trade Organisation states that “Trade financing gaps arise due to a mix of structural and development factors”.

In the context of the report, this notion is used to explain the correlation between developing countries and the trade finance gap. However, it also highlights the necessity and opportunity for the involvement of trade finance in ESG centric businesses. This is because the established business practices of the last 100 years have been largely characterised by resistance to ESG.

The concept of ESG has been there around for years, but the lack of awareness and concern for the environment has created a knowledge gap amongst the public regarding the topic.

Without proper structural and developmental resources in place, ESG centric companies may find it difficult to compete initially, even with a strong ESG proposition.

Trade finance can help to alleviate this market failure through sustainable financing. In fact, through sustainable investment practices, trade finance can drive ESG implementation at the core of businesses worldwide.

Through selective funding, trade finance practitioners have the power to incubate the strongest ESG propositions. With the growing sustainable financing and investing practices, demand for trade finance is bound to increase which can potentially narrow the trade finance gap to some extent.

For example, in 2019 HSBC partnered with Walmart to implement a sustainable supply chain finance programme with the aim of avoiding 1 gigaton of greenhouse gases by 2030. This program fixes supplier’s financing rates in accordance with their sustainability rating. Suppliers who show progress towards Walmart’s Project Gigaton or Sustainability Index Program can apply for better financing from HSBC.

Being the largest company on Earth by revenue, Walmart’s participation in such a large ESG trade finance scheme indicates the viability and longevity of this emerging trend.

Challenges to Integrate ESG in Trade Finance

It is clear that ESG has the potential to generate massive value for the world economy. Even free market economist Milton Friedman states that

“It may well be in the long-run interest of a corporation… to devote resources to providing amenities to that community or to improving its government”.

Sustainable finance is simply the free market pre-emptively correcting the market failures of the future.

However, there are two main factors that inhibit the immediate realisation of this value for trade finance practitioners:

Information Gaps

A major hurdle is that many countries have no legal obligation to disclose their ESG related data publicly. This can make it difficult to create performance benchmarks and targets.

There is a limited amount of ESG indexes, particularly when concerned with trade finance. However, with the introduction of legal requirements such as the Sustainable Finance Disclosure Regulation in the EU information gaps are becoming smaller every day.

With the increasing importance of sustainable trade financing, legislatures are working to bridge this information gap.

Lack of Uniformity

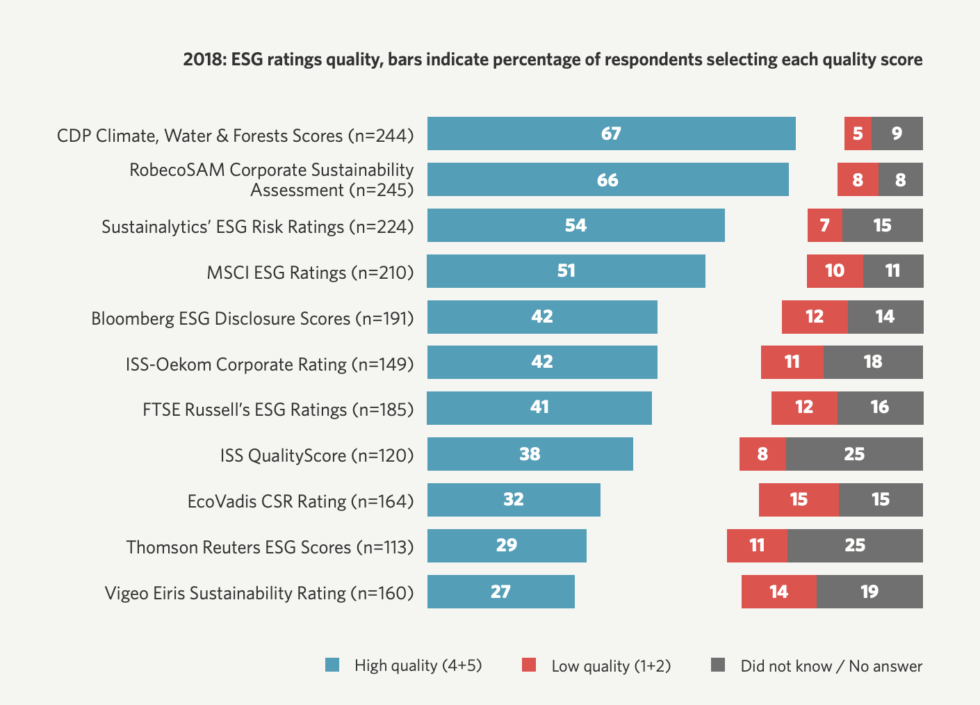

Unfortunately, there is no gold standard for ESG scores. As sustainable financing becomes more popular, analytics companies in the ESG space are battling for the top spot.

To exacerbate matters, there is also often a disparity in usefulness between ESG ratings coming from different firms.

This is because different analytics firms have different parameters and definitions of conformance. Significant differences in the conformance ability of different sectors can create even further comparability issues.

The result is that it can be difficult to quantify what one rating means and harder still to compare between them.

Future of Trade Finance with ESG

In the future, we can expect a continuance of the rising trend towards sustainable financing.

There is a growing pool of evidence that ESG centric companies yield greater long-term risk adjusted returns for investors.

As such, assets with strong ESG propositions will become more popular while others are left behind.

In response to the rising demand for sustainable assets, we can also expect an increased analytical presence in the ESG space.

More legally enforced ESG data disclosure will lead to better transparency and more reliable indexes. The exchange of more cogent information will lead to more prosperity for the most successful ESG propositions.

Hopefully, we will also experience a technology-driven standardisation of ESG data and the analysis that comes from it.

The development of trade-oriented software and FinTech solutions accommodating ESG will conceivably alleviate both information gaps and comparability issues.

Specifically, within the field of trade finance, it is extremely unlikely we will see a downturn in the popularity of ESG centric assets.

A study conducted with 902 publicly listed companies in the US from 2002-2017 found the “probability of corporate credit default to be significantly lower for firms with high ESG performance”. This makes commercial risk significantly lower for ESG centric assets when compared to their counterparts.

A reduction in one of the three main types of risk in trade finance (commercial, political and financial) is likely to create a bias towards this particular asset class. In turn, this will self-perpetuate in the form of more emerging ESG assets looking to capitalise on growing investor demand and success.

Trade Finance Platform

Digital User-Friendly Diverse

Enable cross-border trade for global markets with Velotrade's flexible financing solutions. Learn More