Covid-19 cases outside China have recently exceeded those in the mainland. This rapid escalation has led to the WHO (World Health Organization) pronouncing a worldwide pandemic. Although cases in China are dropping, the heavy reliance on mainland factories for mass production has left global markets with limited supply chain options.

It is vital to re-balance an investment portfolio and review an existing supply chain during such challenging market circumstances.

Highlights of this article

- Global Measures for Covid-19 by Countries and Governments Impact on different citizens and industries

- Three Possible Recovery Scenarios of Covid-19 Outcomes for the global economy

- Assess Supply Chain Resilience to Reduce Supply Chain Strain 3 questions that traders should ask

How are Global Markets Responding to Covid-19?

The high transmission rate of Covid-19 has placed a large proportion of the world’s population at risk. Governments are now aiming to ‘flatten the curve’ and slow infection rates. Stricter regulations are necessary to avoid overwhelming local health services.

‘Social distancing’ is an essential condition. Limited interaction as schools’ lessons stop and university campuses close. People increasingly work from home, shunning meetings and any large-scale social activity.

Global markets have entered a phase of inactivity. Thus opportunities to spend money are significantly restricted. The most hit industries are hospitality and travel. However, almost all types of economic activity have quickly suffered.

Consumer confidence is profoundly affected too. Companies are struggling to maintain a healthy level of business as revenue drops. The result is a struggle for survival with staff layoffs almost inevitable. The risk of a global recession is growing increasingly real.

Three Potential Outcomes of Covid-19

There is considerable uncertainty about how the Covid-19 crisis will play out. As this virus strain only recently emerged and it is not yet well understood. There is a range of issues that make its progress unpredictable. It includes seasonality (whether it survives well in the warmer temperatures of a northern hemisphere spring and summer).

Also, the impact of undetected, milder cases (the risk of as asymptomatic transmission). The possibility of re-infection by returning citizens also holds the potential to raise patient numbers once more in markets which are initially considered to be improving (such as China).

It is difficult to know the ultimate effect of Covid-19 on global health and economic activity. A fully tested and approved vaccine unlikely to be available for many months. Below we look at three possible outcomes for the current crisis:

1. Quick Recovery

A COVID-19 Briefing Notes published by McKinsey highlights the most optimistic scenario. It accepts that there will be a continuing growth in the number of cases due to the high transmissibility of the virus. In turn, it will lead to a strong public reaction and a fall in consumer demand.

However, Governments are taking active steps to achieve control like China. The peak of public concern may come within just a few weeks. Given the low fatality rate among children and working-age adults, it is expected that levels of anxiety may diminish.

While the disease continues to spread, older people – and especially those with underlying conditions – take extra care to protect their health. Most citizens are likely to adopt more careful behaviour such as social distancing. Also, there is an assumption that the virus is seasonal and will be significantly affected by the warmer weather of spring and summer.

Outcome

Under this scenario, global GDP growth will fall from the previous estimate of 2.5 per cent to about 2 per cent during 2020. China will be making the most significant contribution to the fall (down from 6 per cent to about 4.7 per cent). East Asia will fall by 1 per cent and other large economies around the world down by around 0.5 per cent. China will restart factory output (although customer confidence on the mainland might only recover by the end of Q2 2020).

2. Global Slowdown

This scenario assumes that gradual control of the virus worldwide takes place somewhat slower than achieved in China. High transmission rates occur across Europe and the US, but on a localized basis. It is due to the competent government countermeasures and social distancing implemented by individuals and firms. The expectation is for some spread across Africa, India, and into other densely populated territories. The transmissibility of the virus will decline naturally with the onset of the northern hemisphere spring.

For the United States, there is an assumption of between 100,000 and 500,000 cases in total. One major epicentre has 40 to 50 per cent of all cases. Two or three smaller centres have a similar amount, and the remainder spread more widely. This reaction may last for six to eight weeks in cities with active transmission, three to four weeks in neighbouring towns. The resulting demand shock can cut global GDP growth in half during 2020, reducing it to between 1 per cent and 1.5 per cent. Overall, it will put the global economy into a slowdown but not into full recession.

Outcome

In this scenario, a global slowdown would affect small and midsize companies more than large corporations. Less developed economies would suffer more than advanced markets. Not all sectors would be equally affected. Service sectors – such as aviation, travel, and tourism – would likely to be hardest hit. Airlines would be suffering a steep fall in traffic in the busy summer season leading to bankruptcies and market consolidation.

The steep drop in consumer confidence would likely mean that much market demand is delayed. The above has implications for many consumer product companies (and their suppliers). They operate with limited working capital and a narrow margin for profitability. Demand will rise in May–June as concerns about the virus diminish. Most other sectors would also be profoundly affected due to the drop in national and global GDP. Oil and gas, for example, adversely affected as oil prices stay lower than expected until Q3.

3. Pandemic and Recession

This scenario is similar to the global slowdown outlined above. This one assumes that the Covid-19 virus is not seasonal and will not be moderated by spring warming in the northern hemisphere. High levels of re-infection by travellers crossing national borders may also add to the continuing case growth.

Outcome

It is expected through Q2 and Q3, to overwhelm the healthcare systems around the world. It would delay the recovery in consumer confidence to Q3 or beyond. The severe economic impact of this most pessimistic scenario is likely to result in a full recession. Global growth in 2020 will be falling to between –1.5 per cent and 0.5 per cent.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Know the government measures taken to revive global supply chains during these tight economic situations.

Reducing the Strain of Covid-19 on the Supply Chain

The wide range of possible outcomes to the current crisis reflects the fact that there are still many unanswered questions about the full effect of the virus.

However, there is little doubt that Covid-19 is a major black swan event impacting healthcare on a global scale. It will be slowing the economy in a way that few crises have achieved in recent history.

It is a major test for the global supply chain at a time when they are already under pressure from the prolonged tension between US and China. While China’s role as the primary producer of goods is still unchallenged, the impact of Covid-19 has underlined the risk of depending on a single source for manufactured goods and components – no matter how efficient and cost-effective.

China is likely to see a 0.2% to 0.5% reduction in GDP – equivalent to as much as 500 billion renminbi. According to Bain & Company, Covid-19 is likely to be as much as five times more troublesome than the SARS crisis of 2002-3. Many industries will be hard hit including food and beverage, discretionary consumer products, automobiles, electronics, machinery, electrical equipment and traditional retail businesses.

Given the above, each importer or brand with a vested interest in mainland production needs to ask some fundamental questions, starting with the following question.

‘How Resilient is Our Supply Chain’?

Each business needs an intimate understanding of every one of its suppliers – not just the main factories, but also the second and third-tier subcontracted partners. The goal here is to identify problems before they become major issues that impact delivery schedules.

For example, lithium-ion batteries are critical components of many electronic goods. They alone can disrupt supply chains for electric vehicles, personal computers, cell phones, power tools and electricity grid storage systems.

With a greater depth of knowledge, the next question to ask is:

‘How Can we Successfully Diversify Production?’

The current crisis highlights the weaknesses in the supply chain. To solve this, companies must diversify the source of production to include other manufacturers at a similar cost level in Asia. Also, it is worth relocating part or all the manufacturing process closer to home.

Finally – and perhaps the most urgent question:

‘How Secure is the Financing of Our Current Suppliers?’

It is important to remember that manufacturers sometimes face cash flow issues when handling large large-scale orders for international clients. At a time of economic uncertainty, they may confront challenges that can disrupt business and place important orders at risk.

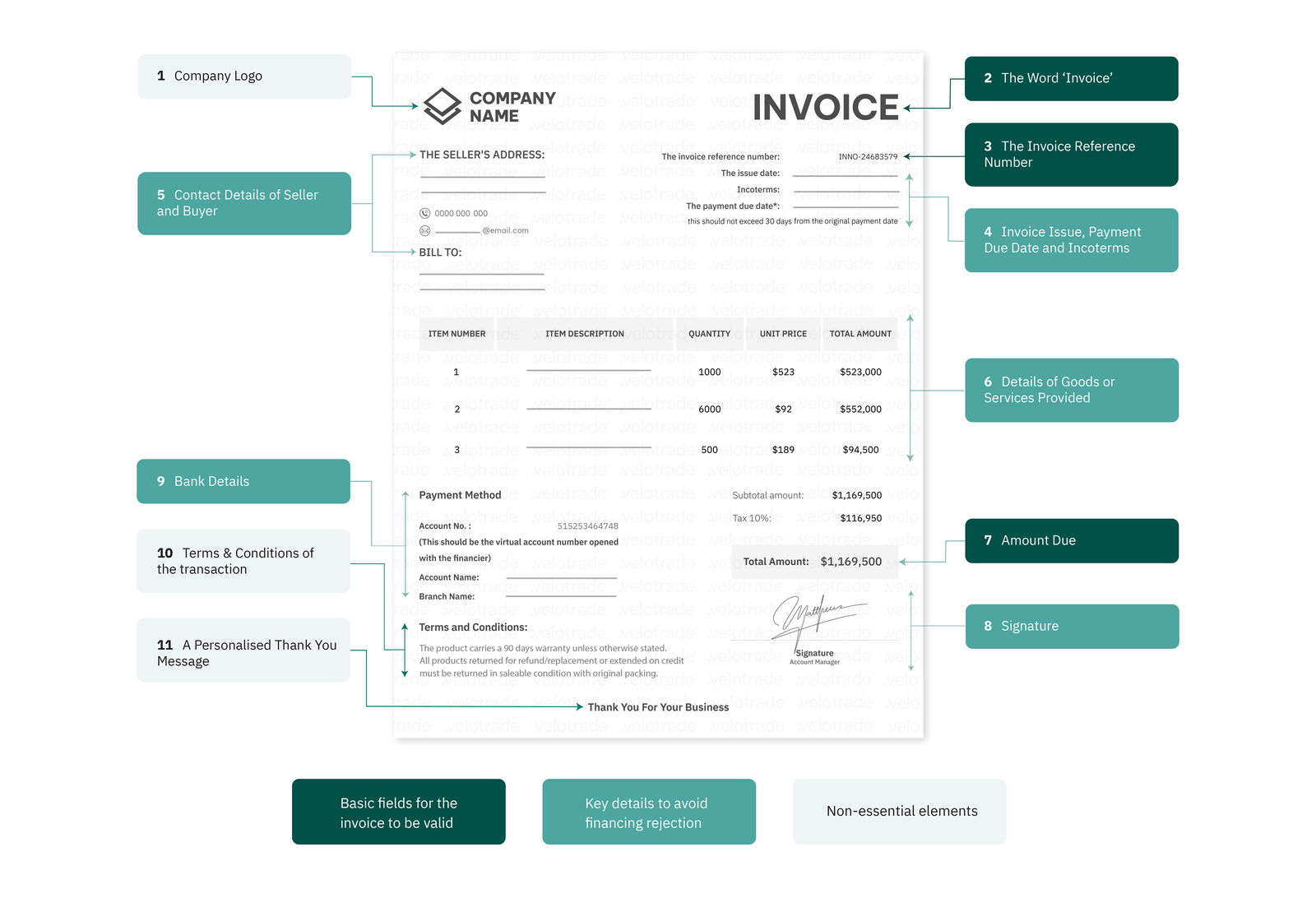

Customers with stable finances can leverage their banking relationship to help fund supplier invoices and solidify their partner’s position through Invoice Financing via online platforms like Velotrade.

Reach out to us and get the financing solution best fit for your business needs to support it during such difficult times.

Financing with Velotrade

Collateral-Free Hassle-Free Paper-Free Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions. Explore Velotrade financing solutions