Worrying about adequate funding can easily lead to sleepless nights for any manager of a small or medium size enterprise (SME).

Fluctuating order levels, variable overheads and the need to purchase materials in advance – all these factors make it hard to judge exactly when additional working capital will be required.

So it pays to consider the financing options available before a substantial new order causes a major headache due to limited resources and over-stretched cash flow.

The Complex Reality of Bank Loans

A bank loan may be the first option that comes to mind when cash is tight, however mainstream financial institutions have been increasingly reluctant to lend to SMEs since tougher regulatory requirements were established after the financial crisis of 2007-8.

Before releasing funds, bank managers want to know how the money will be spent – often requiring budgets and supplier quotations – as well as asking for details of the company’s overall business strategy, its customer relationships, accounts payable status and inventory situation. Company accounts may also be closely analysed with particular attention paid to credit history and cash flow. Legal covenants are sometimes put in place by banks to manage borrower behaviour: if targeted debt-to-asset and interest coverage ratios are not consistently met, the borrower faces the risk of the loan being terminated.

In short, applying for a bank loan can be an exhaustive process – and there is always the chance that it may be declined, because large financial institutions are sometimes reluctant to deal with SMEs when they can focus on larger, more profitable transactions.

Invoice Financing: a Convenient Alternative

When searching for alternative financing options, SMEs can consider invoice financing which enables companies to receive advances on their outstanding invoices and more quickly expand their business.

Today, self-service, online platforms such as Velotrade are accessible from any connected screen or mobile device. The entire process is digital and there is no need to visit a bank branch or office, wait in a line, or fill in paper forms.

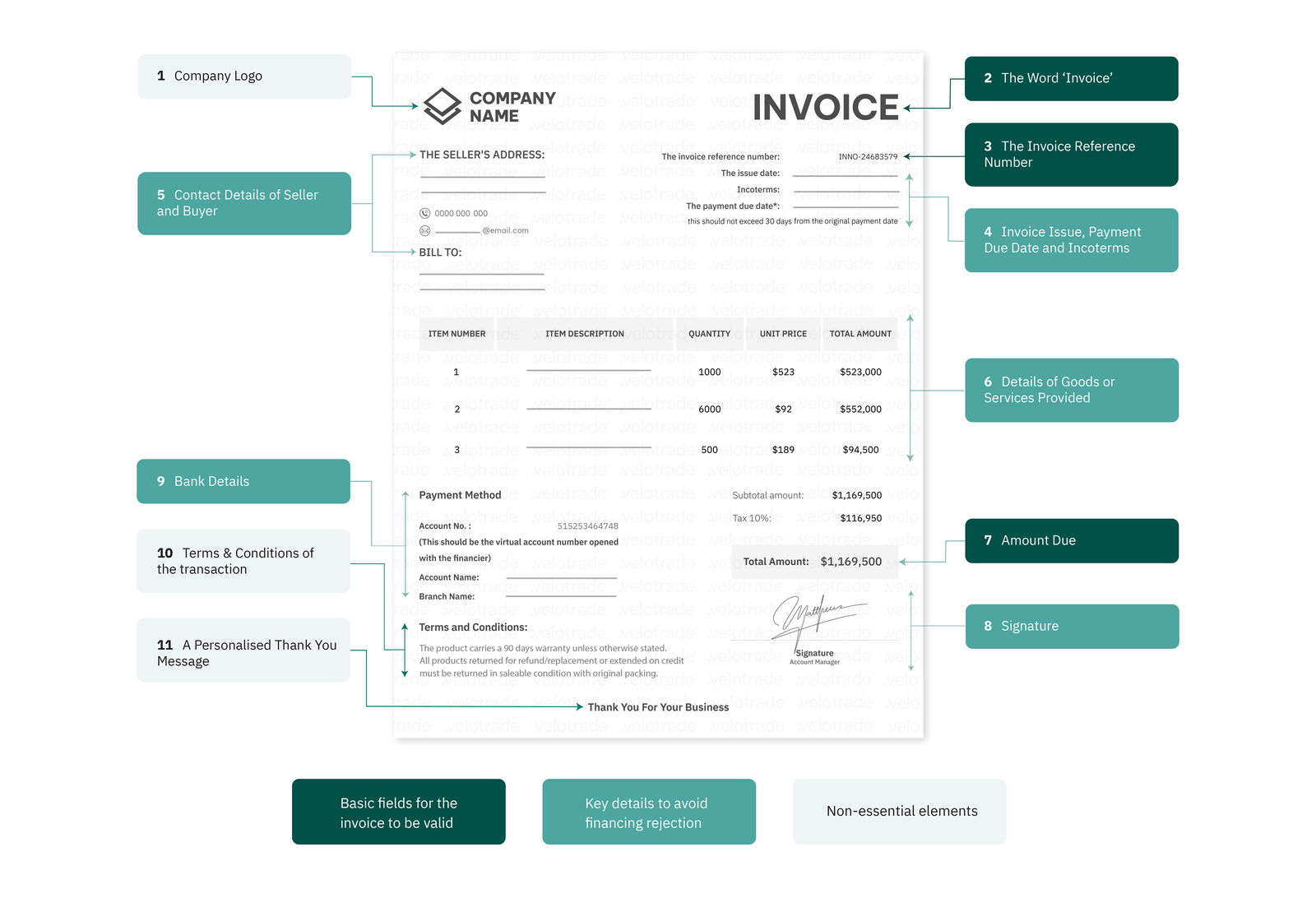

Following a straightforward due diligence process, users gain access to the full platform and can post invoices for financing.

An auction is created for the invoices submitted and a range of pre-approved, professional investors are then able to provide funding.

The transaction completes within a few days and funds are transferred to the user’s bank account as soon as the auction ends.

Each invoice seller immediately receives eighty to ninety percent of the invoice value to meet their funding needs, with the remainder to be paid once it has been settled in full by their customer.

Costs are kept to a minimum to ensure affordability of the service and the platform charges a small percentage of the invoice amount for each transaction.

Simplifying Due Diligence to Ensure Successful Funding

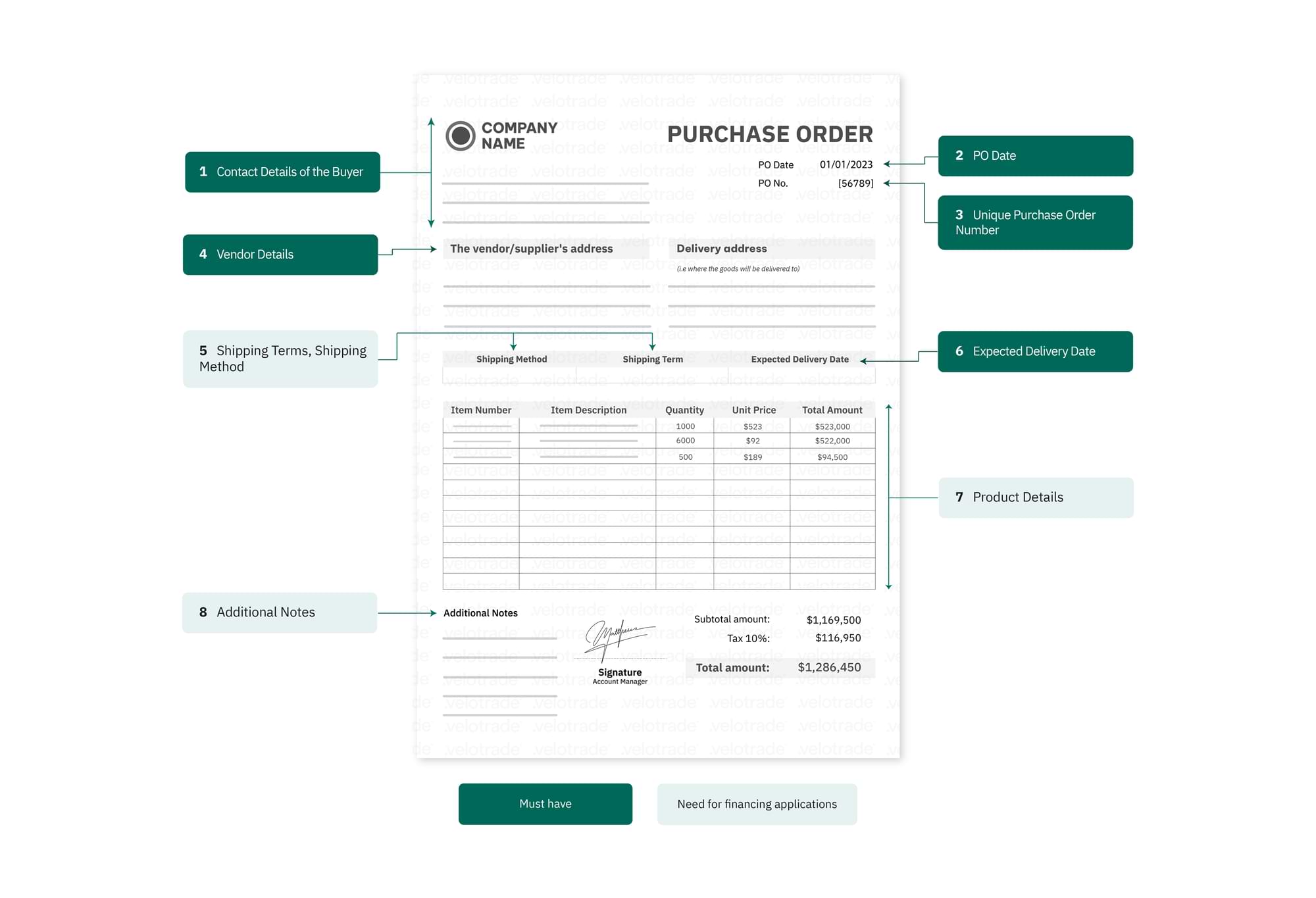

When delivering trade finance Velotrade focuses on the commercial transactions between Sellers and the Buyers of their goods or services. The merits of each individual transaction are assessed to ensure there is a healthy commercial relationship between the two parties, asking questions such as:

Has there been a reasonable transaction volume in the last 12 months?

Have there been any significant disputes?

Does the buyer pay on time?

In this scenario, the Seller enjoys a relatively pain-free due diligence procedure during which the company’s financial statements are carefully reviewed. This highly efficient approach with a minimum amount of inconvenience is possible because it is the Buyer who is ultimately responsible for settling each invoice and their assessment may be undertaken by a trade credit insurance provider and Velotrade credit team.

At the same time as due diligence, a straightforward compliance process is undertaken to include: Know Your Client (KYC) which necessitates identifying the ultimate beneficiary owner of a company and Anti Money Laundering (AML) to confirm there is no funding of illicit activities.

By contrast, banks take a more cautious approach and before agreeing to finance an invoice, they typically insist on a time-consuming study of the background of both buyer and seller, including much superfluous information.

Furthermore, the conservative nature of banks means that a series of transactions over a 12 month period is often required from Trade Finance clients, and significant collateral demanded, or financial charges placed against company property or machinery.

Conducting Trade Finance on the Velotrade platform is more efficient simply because each invoice is treated as an asset with a tangible value and once a thorough client assessment is complete, the investor auction and money transfer can immediately follow.

This flexible, no-hassle approach to delivering financial help to SMEs provides an important alternative source of funds available at any time to match the trade cycle.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Financing with Velotrade

Collateral-Free Hassle-Free Paper-Free Stress-Free

Receive payments before invoice due dates efficiently with Velotrade's financing solutions. Explore Velotrade financing solutions