Managing financial risk is a basic necessity for running any business. Risk management helps optimise earnings and mitigates financial and reputational damage. Also, it ensures the smooth execution of day-to-day operations.

A comprehensive risk management plan can help to anticipate future issues. Those issues could be delayed payments or defaults, along with the regular ups and downs of the business cycle. SMEs don’t need to imitate large companies in dedicating entire departments to risk management. In fact, CFOs don’t need to commit vast resources to it. Risk management practices can scale with the business in question.

For smaller businesses, it’s possible to lower risk by covering the four basic forms of it:

Market Risk

Market risk refers to risks that come from the overall business environment itself. The circumstances causing changes in the market are not controllable by SMEs.

As an example, countries in the ASEAN region are growing more integrated. As a consequence, cheaper and more advanced products are in the market. Thus, local businesses may find their market share threatened by competitors.

Besides the emergence of new competitors, businesses will face the natural consequences of changes in the cycle. Manufacturing output may shrink as a result of political disputes. Government policy intervention in a product or service is also an important factor.

SMEs will also feel the impact of economic downturns or trade disruptions. On a macroeconomic level, companies feel the effects of economic downturns. Likewise, trade disruptions affect export-dependent businesses, such as the shipping and manufacturing sectors. For example, the Sino-US trade tensions and Brexit, have both harmed Hong Kong’s economy in Q1 2019.

Market Risk Management Solutions

In mitigating market risk, it is crucial to monitor the market. News and stakeholder feedback can provide critical information. The slim structure of SMEs allows managers to have a higher degree of flexibility. Corporates can implement directional changes or modifications to products and services when needed. When possible, managers need to get feedback from customers.

As a form of risk mitigation, businesses should always be experimenting and evolving their products and services. They can aim to diversify, and not be dependent on a single product line or single service.

Businesses can also focus on building deeper interpersonal relationships with customers. Also, delivering superior products and fantastic user experience helps create brand loyalty. Thus, it will help meet market changes and consumer expectations. As a result, customers will not buy from someone else regardless of convenience or small cost efficiencies.

Local SMEs can also take advantage of lowered trade barriers to find broader markets and diversify their business. Companies should strive to expand and move beyond their borders. It can help during economic downturns as the company is not dependent on a single market to sustain itself.

Credit Risk

Credit Risk is the most common risk facing SMEs. Clients may not always pay on time and this can disrupt businesses’ cash flow. Unfortunately, loans through banks don’t solve the issue. Traditional financial institutions have credit requirements that SMEs may struggle to meet.

For example, banks may require a long track record of profitability. Also, they can ask for collaterals in the form of property or machinery or fixed deposits.

However, pledging or owning such assets could create liquidity risk (see below). As a result, businesses are trying to mitigate one threat at the risk of another.

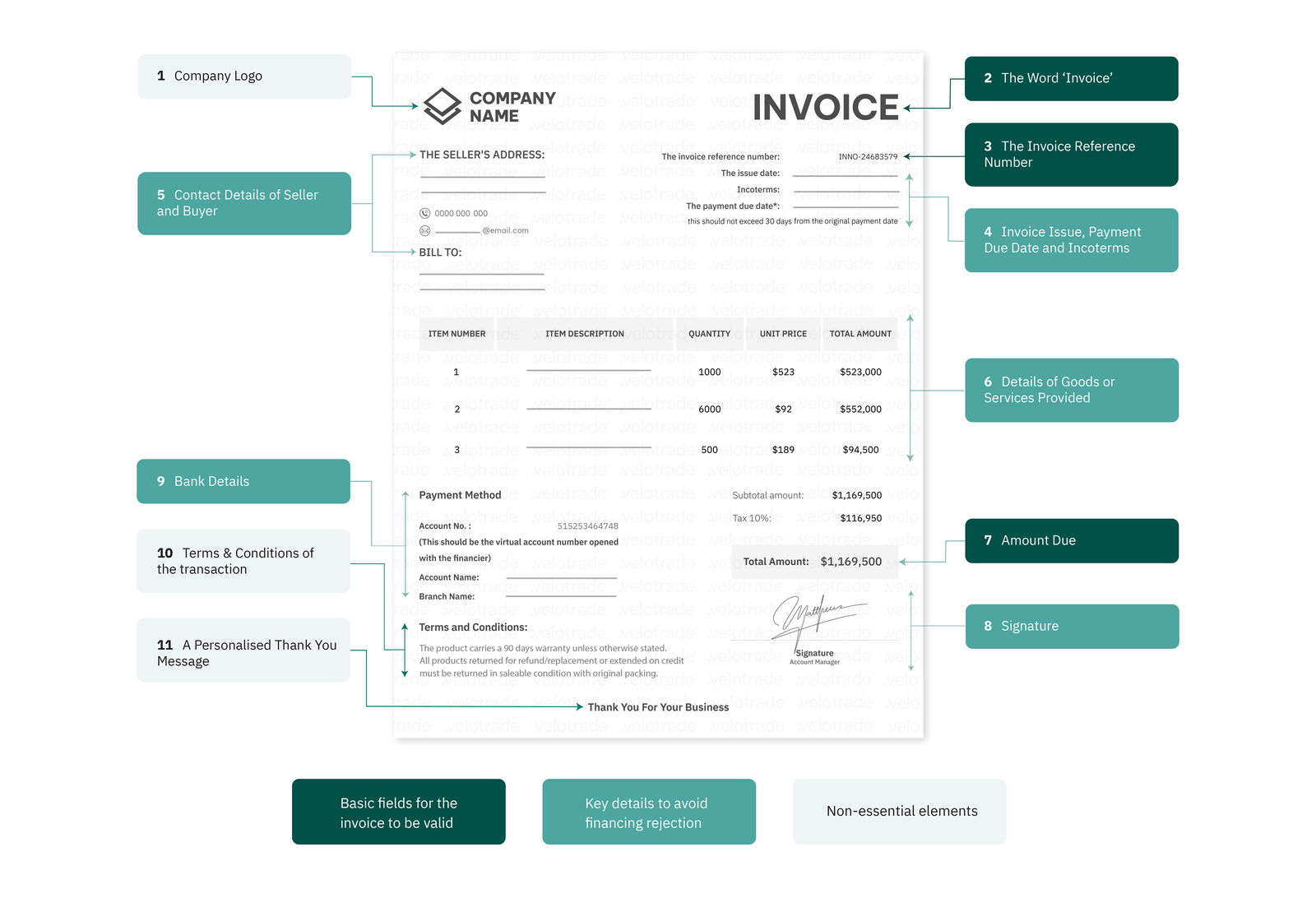

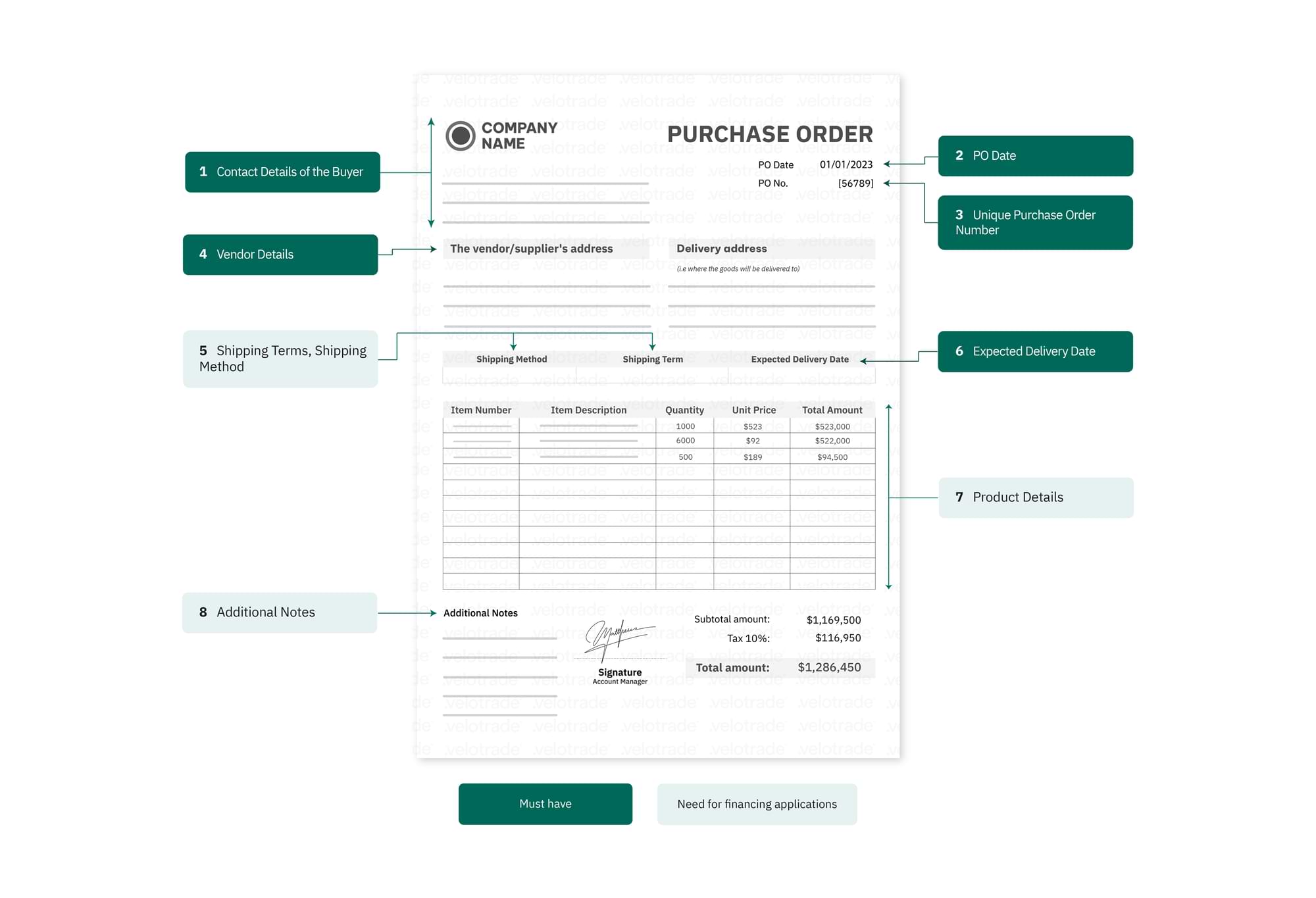

Compiled here are a few ways to improve cash flow that could be worth a read!

Brought to you by Velotrade, a marketplace for corporates to access financing.

Liquidity Risk

Liquidity risk occurs when cash is locked up in some parts of the business. Hence, the company is unable to pay its short-term debt obligations.

A simple illustration is a business having a significant forecast from a client resulting in a high inventory of a specific product. The order is cancelled due to client default, causing the small amount of cash the business had locked in unsold inventory. At the same time, the company needs to pay its short-term debt. The only way to move forward is to sell the product at a substantial discount resulting in a loss.

Another example, linked to credit risk lower down the chain is bad debt derived from poor credit management. If the company has a low cashflow and is reliant on client payment to repay short-term debt, it will not be able to do it, putting the business at risk.

Liquidity Risk Management Solutions

High cash-intensive operations should be adequately considered with all its implications before actualising it. Businesses must practice proper and strategic cash flow management. It will prevent the company from facing troubles in paying their short-term debts.

Monitoring the liquidity of the company can be a start. Tools such as financial ratio comparing short-term assets to short-term liabilities should be monitored and put into place.

Operational Risk

Operational risk pertains to the potential threats and hazards that arise in the course of doing business. It relates to the day-to-day activities and set up processes that make the business able to deliver its products or services. Different industries have different operational risks.

For example, in the manufacturing industry, two maintenances of machines are required, and the business can only afford one. Making the best decision is critical for the business’s ability to sustain its operations.

In another industry, the highest risk could be considered legal, such as violating copyright or trademark laws by accident. Furthermore, having lapses in accounting and taxes is regarded as an operational risk.

Operational Risk Management Solutions

Businesses should be open to consulting third party experts to mitigate some operational risks. Financial advisors, company secretary, and lawyers are just some experts that would help deal with such threats. For example, legal consultations are cheaper than an actual lawsuit.

Conclusion: Focus on Mitigating Risks

The rationale is simple. Businesses should address credit and liquidity risk with proper cash flow management. Cash is the lifeblood of a business and is critical for other forms of risk management.

If a company wants the resources to innovate or expand overseas, it will first need to secure the finances required. A business that has the right monetary resources is also better insulated from market and operational risks.

Financing working capital provides greater liquidity to companies. It helps businesses gain adequate capital for regular operational maintenance and for hiring the right experts like lawyers or accountants to provide crucial advice and guidance.