Almost 13 years after the first iPhone was unveiled by Steve Jobs, people everywhere are absorbed in a digital experience delivered direct to their smartphone screens by corporations like Google, Amazon, Facebook and Apple.

Among these household names Amazon took top ranking in 2019 as the world’s most valuable brand worth more than USD 315 billion(1), on the back of controlling nearly 40% of all US e-commerce transactions; 40% of paper book sales; 33% of streaming video; and almost 50% of the cloud computing industry through Amazon Web Services (AWS)(2).

The company’s ‘Customer Obsession’ (to use Jeff Bezos own words) has leveraged technology – including AWS and Machine Learning tools – from the earliest stages of its history to collect and analyse customer data, achieving an industry-leading average revenue of more than USD 189 per unique user(3).

Know how eCommerce personalisation builds consumer loyalty through better targeting.

Since late 2014, Alexa has gradually evolved into a highly popular virtual assistant putting the company at the fore of development in AI (Artificial Intelligence) and enabling Amazon to rollout a platform for third party developers and hardware manufactures to integrate it with their products.

Throughout a period of unalloyed growth, Amazon has continued to experiment with new products, services and delivery methodologies, such as the highly popular Prime. As a result, growing volumes of customer data have helped to drive more accurate decision-making and greater business efficiency; improving product development and promotion to further boost sales.

There are plenty of lessons to be learned from Amazon about how any business can maximise the value of technology – such as the need for clear strategic planning, a powerful customer focus, in-depth data analysis and early adoption of key tech trends such as AI.

Nowhere is that instruction more pertinent than for the finance sector, where innovation slowed as regulation took precedence following the global crisis of 2007-2008; and where digitisation is only now being gradually adopted by many traditionally-minded banking players(4). Furthermore, powerful legacy players, intensive industry oversight and government intervention also serve to limit growth.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Fintech Ecommerce Financing solutions are transforming traditional financial services making it much more accessible for firms to obtain capital!

Challenges of a Fast-Changing Marketplace

One of the key developments in financial services lies in payment platforms where consumer giant such as Tencent – through WeChat Pay app – has already built a base of more than 900 million active customers. With close to ten times more customers than the largest traditional bank, WeChat has a great deal of data to use in making credit decisions and an opportunity to seize significant market share from competitors(5).

As the barriers between technology and finance grow increasingly indistinct, other large consumer tech companies – primarily Facebook and Google – are set to target financial services such as the Payment space, inevitably leading to an intensification of competition, higher levels of automation and staff-cutting as market consolidation takes place.

Long established banks and other large finance market players risk loosing a large part of their business unless they digitise effectively, and so they must be ready to address such threats by developing a focused plan to address imminent market disruption(6).

However, many of these incumbents have struggled to cope with the fast changing industry landscape, cutting low margin services and effectively leaving gaps in the market that new service providers now hope to fill.

Technology offers a potential way out of this conundrum: trends such as Cloud Computing, AI and Voice Recognition can be combined to deliver a new generation of more profitable financial services.

Unveil the power of data in eCommerce to understand its impact on businesses.

The lesson for established players is change or face failure. While such innovation requires a substantial financial investment, the alternative does not bear thinking about. Survival depends on mastering the technology.

One option that banks can consider is implementing ‘white label’ services from Fintech companies to help fill gaps in their existing portfolio of financial solutions. This alternative to in-house development can sidestep internal organisational obstacles and speed execution of a new strategic new direction to address the fast changing marketplace, while gradually moving towards digitising a broader service offering.

FinTechs are Transforming Financial Services

Fintechs such as WeLab, Cortera and Velotrade are finding traction by developing online services that leverage tech to the maximum potential for online banking, credit scoring and trade finance respectively.

Many financial services have legacy IT systems and outdated software which hinders modernisation and the introduction of better processes and new services.

Trade Finance is one example of a service that is severely limited in its ability to meet the fast-growing needs of global exchange in goods and services. As a result the sector is burdened by a USD 1.5 trillion trade funding gap(7).

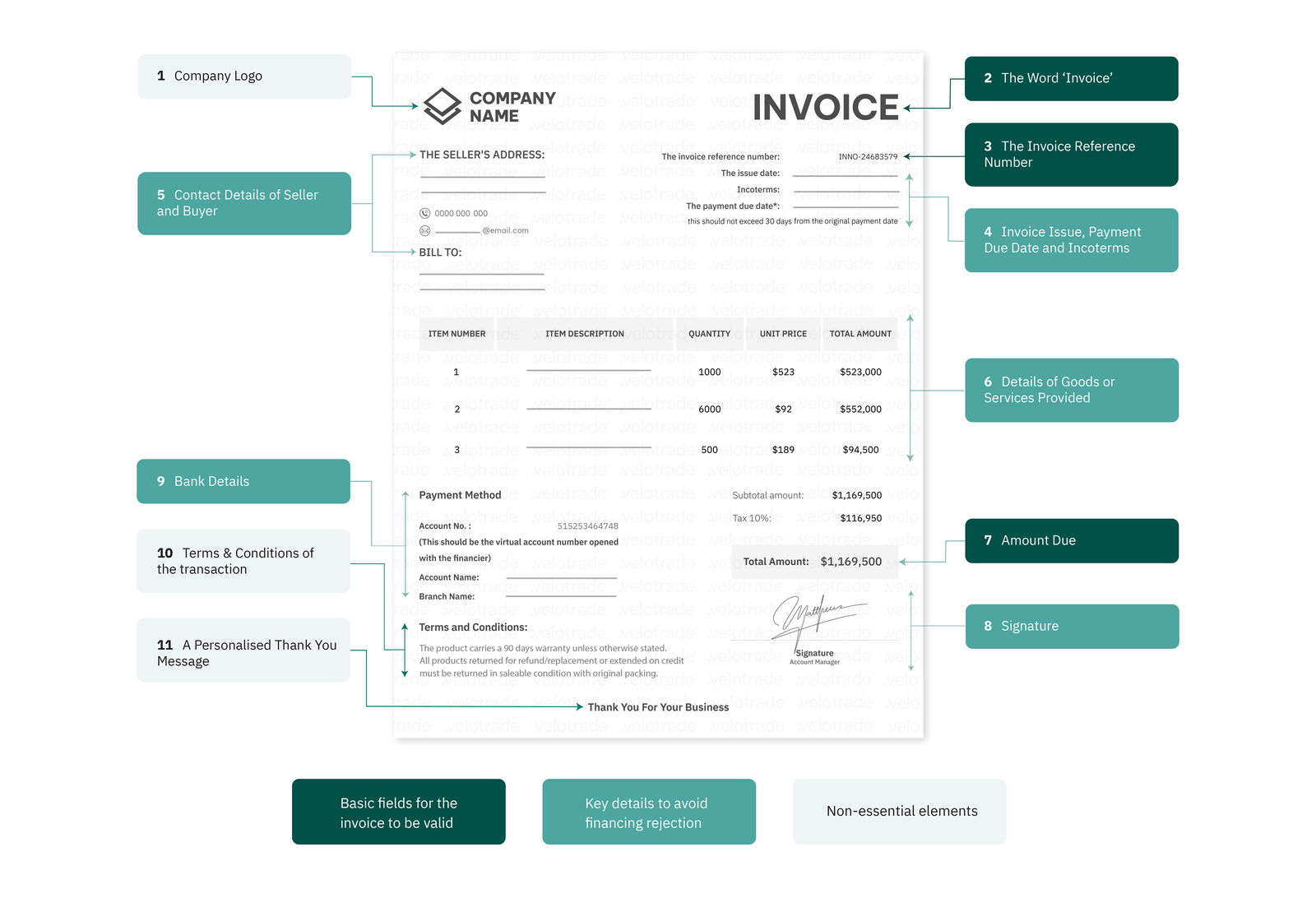

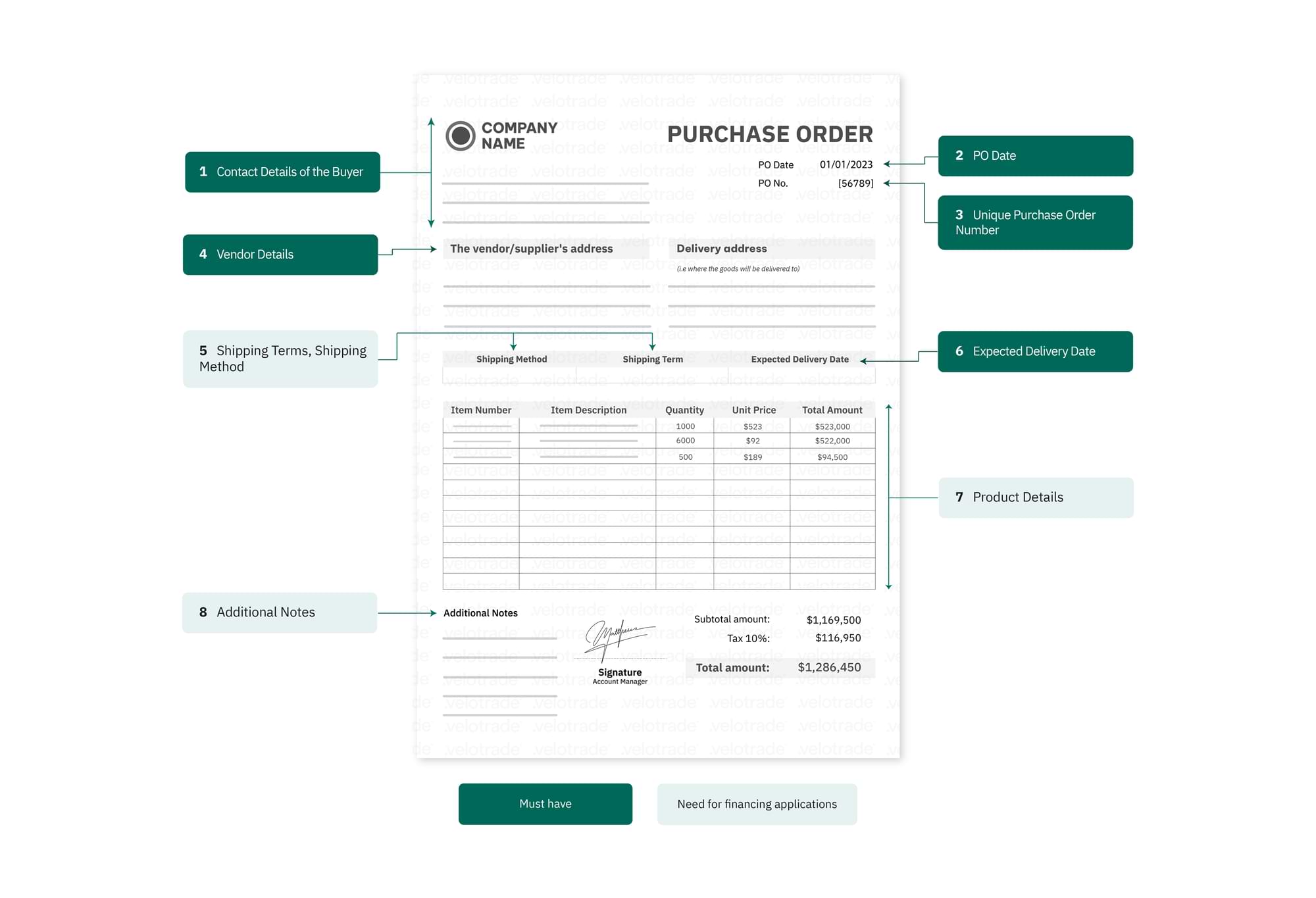

More convenient alternatives already exist including digitised platforms that bring invoice sellers and buyers directly together in the Invoice Discounting (or Factoring) process. Each invoice is individually financed with a few clicks on an app, either on a smartphone or computer screen, via an auction held between pre-qualified potential investors.

Sellers enjoy the flexibility of a service that improves their cash flow, freeing up funds to cover their business operations and working capital requirements, so that they can quickly cover expenses without waiting for invoices to be settled 30-90 days later.

Understanding the eCommerce financing process is vital to fully realise its benefits.

Investors benefit from access to a new asset class – which was previously controlled by banks and large financial institutions – and enjoy a short term investment period with a high level of security at competitive rates of return.

By introducing technology to modernize financial services such as Trade Finance, fintechs are taking a lesson from the Amazon playbook: focusing intensively on meeting customer needs with platforms that maximise user access; leveraging key developments in data analysis and AI; while investigating the benefits of next-generation tools such as Blockchain, in order to continue the innovation process.