The Cash Conversion Cycle (CCC) indicates how fast a company turns produced goods or services into money. This covers the entire journey from production and the supply of goods to sales and payment.

As always, sufficient cash on hand is vital to all businesses, reflecting their liquidity position.

In this article, we will walk you through:

Highlights of this article:

- Is Operating Cycle and Cash Conversion Cycle the Same?

Find out how the operating cycle helps determine the cash conversion cycle - The 4 Elements that Complete the Cycle

Formula of different variables to calculate the cash conversion cycle - Implications of a Short Cash Conversion Cycle

4 ways to shorten your cash conversion cycle - How is a Negative Cash Conversion Cycle a Positive Sign For Your Business?

Uncover the implications of a negative cash conversion cycle

Content

Operating Cycle vs Cash Conversion Cycle

Since operating cycle is a part of the cash conversion cycle, the two measures are often compared and analysed together.

Highly similar by concept, the two differ distinctively by definition. Here’s how!

Operating Cycle is product-centric:

- It calculates the time it takes for a company to convert inventory into cash. This includes the time between when the raw materials are purchased, sold, and paid for by the customers. The cycle ends once cash is received from customers.

- It offers insights into a business’s operational efficiency.

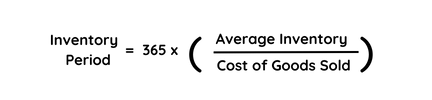

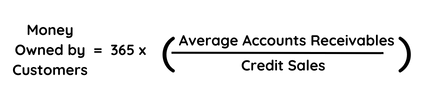

- To calculate this, businesses need to determine their inventory period and money owed by customers.

Inventory Period Formula – Time the goods sit in storage before being sold

Money Owed by Customers Formula – Amount owed to your business by buyers

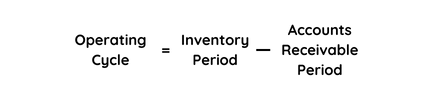

The operating cycle can hence be calculated as follows:

Operating Cycle Formula – Indicates time taken for a firm to receive and sell inventory and collect cash from inventory sold

In contrast, Cash Conversion Cycle is company-centric:

- It measures the time it takes for a company to convert its resources into cash. This includes the time taken to generate cash from assets aside from core products, such as financial investments.

- It indicates the overall cash flow management efficiency of a business.

Cash Conversion Cycle Components

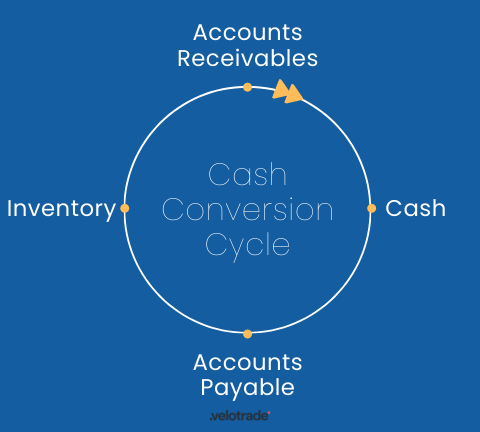

The cash conversion cycle is an essential part of cash flow analysis which is ongoing, recurring and cyclical in nature.

Just like a patio lawn in the backyard, cash flow analysis also requires regular maintenance.

Likewise, to manage cash flow efficiently, cash inflows and outflows should be timed well cyclically. This ensures a business has sufficient cash on hand for revenues, expenses, and receivables.

Here is how the cash conversion cycle works.

Let’s walk through it together.

Accounts receivables are money buyers have promised to pay you within a specific time for the goods purchased. Cash received from them can then be used to pay for any expenses, and repay any debts, i.e. accounts payables. A portion of the remaining money can then be utilised to buy new inventories.

This brings us back to buyers willing to purchase these goods, and the entire cycle repeats!

Calculating Cash Conversion Cycle

The magic formula for calculating a cash conversion cycle includes 3 key variables:

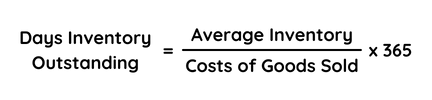

- Days Inventory Outstanding (DIO) – the number of days your company takes to convert receivables into sales.

Days Inventory Outstanding Formula – Days taken to convert inventory into sales

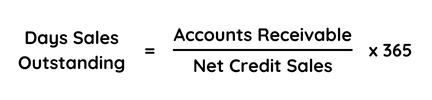

- Days Sales Outstanding (DSO) – the number of days your company requires to receive cash after the inventory has been sold.

Days Sales Outstanding Formula – Days taken to receive cash after inventory is sold

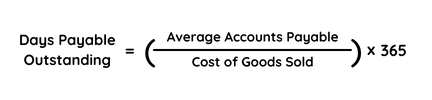

- Days Payable Outstanding (DPO) – the number of days it takes your company to pay back your creditors or accounts payable.

Days Payable Outstanding Formula – Days taken to pay creditors

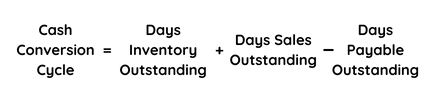

Once we know the above 3 variables, the cash conversion cycle can be calculated as follows:

Cash Conversion Cycle Formula – Days taken to convert inventory into cash

Let’s look at a simple example to understand this.

Suppose Company X sells LED computer screens. It takes them 10 days to sell 100 screens. Computer manufacturers (buyers) have 15 days to pay for the screens. Company X takes around 20 days to pay its supplier for raw materials.

Thus, Company X’s cash conversion cycle is: 10 + 15 – 20 = 5 days. This means it takes Company X around 5 days on average to convert inventory to cash.

What is a Good Cash Conversion Cycle?

A short cash conversion cycle is a good conversion cycle.

A short conversion cycle implies:

- Cash is flowing in at a faster rate

- The business has greater liquidity

- Less money is tied up in working capital

Aim to shorten the cash conversion cycle as much as possible.

By doing so, you will be able to fulfil all payables on time and have a cash surplus to invest in other opportunities.

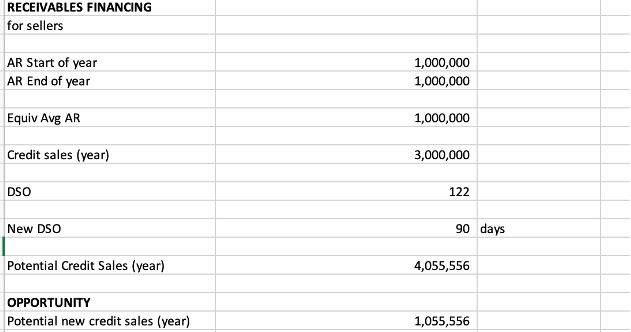

Below is an example of how greater liquidity injection can reduce the potential days sales outstanding.

An increase in credit sales with Receivables Financing potentially reduces DSO.

By injecting more liquidity into the business, its DSO reduced by 32 days with a potential sales increase of $1,055,556.

You may be wondering how to shorten your cash cycle? The next section offers some viable strategies.

How to Shorten Cash Conversion Cycle for Better Sales?

As elaborated above, a shorter cash conversion cycle means more liquidity. More liquidity means more opportunities.

Below are 4 different ways to shorten your cash flow cycle by adjusting its 3 variables – DIO, DSO, DPO as explained above:

- Faster Sales Time

By shortening the deal-making process, your DIO will be shortened.

The smaller the DIO, the better!

A shorter DIO implies that your inventory is turning into sales faster. Of course, this is easier said than done, but you can achieve the target once you have established yourself well in the market.

- Shorter Collection Periods

Another thing you want to do is to negotiate and shorten payment terms with your customers as much as possible.

Lengthy payment terms are often a cause of late payments causing clients to slack off and miss due dates.

An efficient accounts receivables process helps you achieve a more stable and lower DSO. One way to do so would be to incentivise your customers by offering a discount in exchange for a shorter payment period.

For example, one could offer a 5% discount if the customer pays within 30 days instead of 60.

Another helpful tip is to ensure invoices are simple and easy to read. Some buyers may not be familiar with the trading or finance industry.

However, if the terms are easily understood by customers, they are likely to pay you faster. Transparent and clear communication is therefore key to building client trust.

Moreover, the process can be more efficient if automated. Basic client details can be fed into the invoicing software, saving time for future payments. Digital invoices and auto payment reminders by the software further speed up the collection process.

- Strengthen Supplier Relationships

Develop and maintain good relationships with your vendors.

Ask if you could implement a just-in-time inventory system to request and receive goods when needed. This will make the production process more efficient and speed up the collection process.

Open communication and good relationship management are qualities of a successful and reliable business.

- Improve Cash Flow Management

Finally, it all boils down to the ultimate goal for every business: managing and improving the cash flow.

The timing of cash inflows and outflows is crucial here.

If these cash movements are planned and timed well in advance, then your business will continue operating even during unexpected circumstances.

Good cash flow management will eventually lead to a shorter cash conversion cycle.

Key Takeaways

- Operating Cycle is Part of the Cash Conversion Cycle

While operating cycle determines the time taken to convert inventory into cash, cash conversion cycle measures the time taken to convert any production input to cash. - Efficient Cash Flow Analysis Requires Cash Inflows and Outflows to be Timed Well Cyclically

Cash inflow from customers who owe you can be used to pay expenses and buy new inventories. The cycle then repeats! - Calculating a Cash Conversion Cycle Includes 3 Variables

- Days Inventory Outstanding – number of days to convert receivables to sales

- Days Sales Outstanding – number of days to receive cash from sold inventory

- Days Payable Outstanding – number of days to pay back creditors

- A Short Cash Conversion Cycle is Good

This implies a fast cash flow, greater liquidity, and less money tied in inventory. - A Business Can Shorten Cash Cycle in 4 Main Ways

This includes a faster DIO, a lower DSO, strong supplier relationships, and good cash flow management.

Can a Business Have a Negative Cash Conversion Cycle?

Indeed, they can!

As mentioned earlier, a lower cash conversion cycle is good for your business. A negative one is even better.

Many online businesses have a low or negative cash conversion cycle because they don’t hold inventories.

A process called drop shipping is applied instead, where manufacturers, distributors, or wholesalers deliver goods directly to customers. In this way, businesses get paid right away as they do not pay for inventories until customers have paid.

This systematic approach makes the cash cycle a lot more efficient and effective.

So, a negative cash conversion cycle is a very positive sign for your business, indicating growth and expansion. This implies that your business does not need extra cash as it grows.

Likewise, having a negative cash flow is not a bad sign for your business either. Delve deeper into what negative cash flow means for a better understanding.