Cash flow problems can kill even the most profitable of businesses.

Multinational and Small-Medium sized companies alike struggle to maintain a healthy cash flow. Therefore, identifying the causes is essential for sustainable growth.

Highlights of this article:

- Impact of the Late Payment Culture

Delay from buyers, insufficient cash reserves, inventory overstock, rapid business growth - Insufficient Cash Reserves

On average, businesses have reserves for 27 days to cover their cash outflows - 5 Common Causes of Cash Flow Problems

While the issue is common, the causes are often uncertain. Let’s dig further! - Business Case Study

Home Depot survived bankruptcy by fixing its cash burn rate, discover how they did it

Content

While revenue and profits signal strong financial performance, cash flow drives growth. For a business to thrive, cash inflows and outflows must be timed cyclically. This is not easy, as businesses often face several cash flow hurdles along the way.

However, some of the most common cash flow problems can be mitigated by learning their root causes.

Let’s dive into the 4 most common cash flow problems before understanding the causes.

Brought to you by Velotrade, a marketplace for corporates to access financing.

Like our content? Follow us!

Learn the definition of cash flow before reading further if you are unsure.

4 Common Cash Flow Problems

Cash flow issues are inevitable.

A business undergoes a cash flow problem when its cash outflows exceed inflows.

With a host of cash flow challenges, below are four common reasons why a business might be struggling:

-

Late Payments from Buyers

This is one of the biggest cash flow issues affecting businesses.

As businesses need to pay expenses, a delayed payment reduces cash inflows while adding pressure to pay bills on time.

Businesses might be falling in a vicious cycle of inability to make payments (suppliers, loans, salaries) that may cause them to collapse.

Late Payment Culture

Late payment phenomenon is a significantly growing trend in the US and the UK.

The US receiving the largest value of invoices was the worst late payer in 2019. US companies take an average of 51 days more to settle invoices to UK firms.

Overall, 43% of invoices were paid late by UK companies.

These late payments vicious cycle has a crippling effect on the supply chain.

On a study done by Nexus, 51% of suppliers claim that they received more late payments in 2021 compared to previous years.

However, Previse revealed that businesses tend to pay their smaller suppliers 30 days later than their bigger counterparts.

A study conducted by the FSB in the UK showed that nearly 50,000 SMEs close each year due to slow payments!

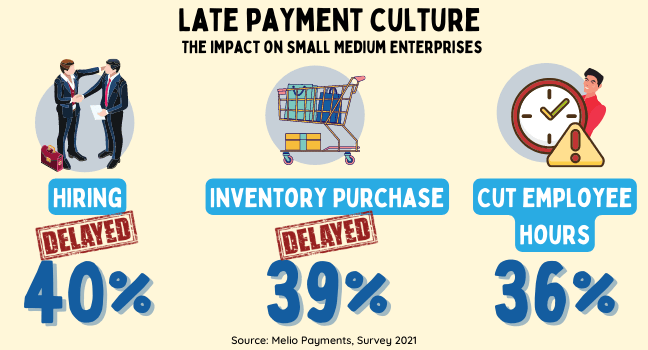

This has caused SMEs to:

- Delay Hiring 40%

- Delay Inventory Purchase 39%

- Cut Employee Hours 36%

The impact of late payments on small medium enterprises.

The primary reason behind this is cash flow issues faced by buyers.

Poor cash flow is one of the biggest killers of small businesses. In a survey conducted by the US bank, a massive 82% stated cash flow problems as their major reason for business failure.

Was it not for these delays, businesses could invest this money to grow and repay debts more quickly.

It is essential for businesses to know how to tackle late payments to avoid recurrence of such delays in future.

-

Insufficient Cash Reserves

While a major problem is cash shortage due to delayed or no cash inflows, another is not having enough cash to battle this shortage.

Cash reserve is an essential safety net that gives your business cushioning against unprecedented or unexpected circumstances.

However, many businesses struggle to maintain a good cash reserve to sustain during low cash inflow periods.

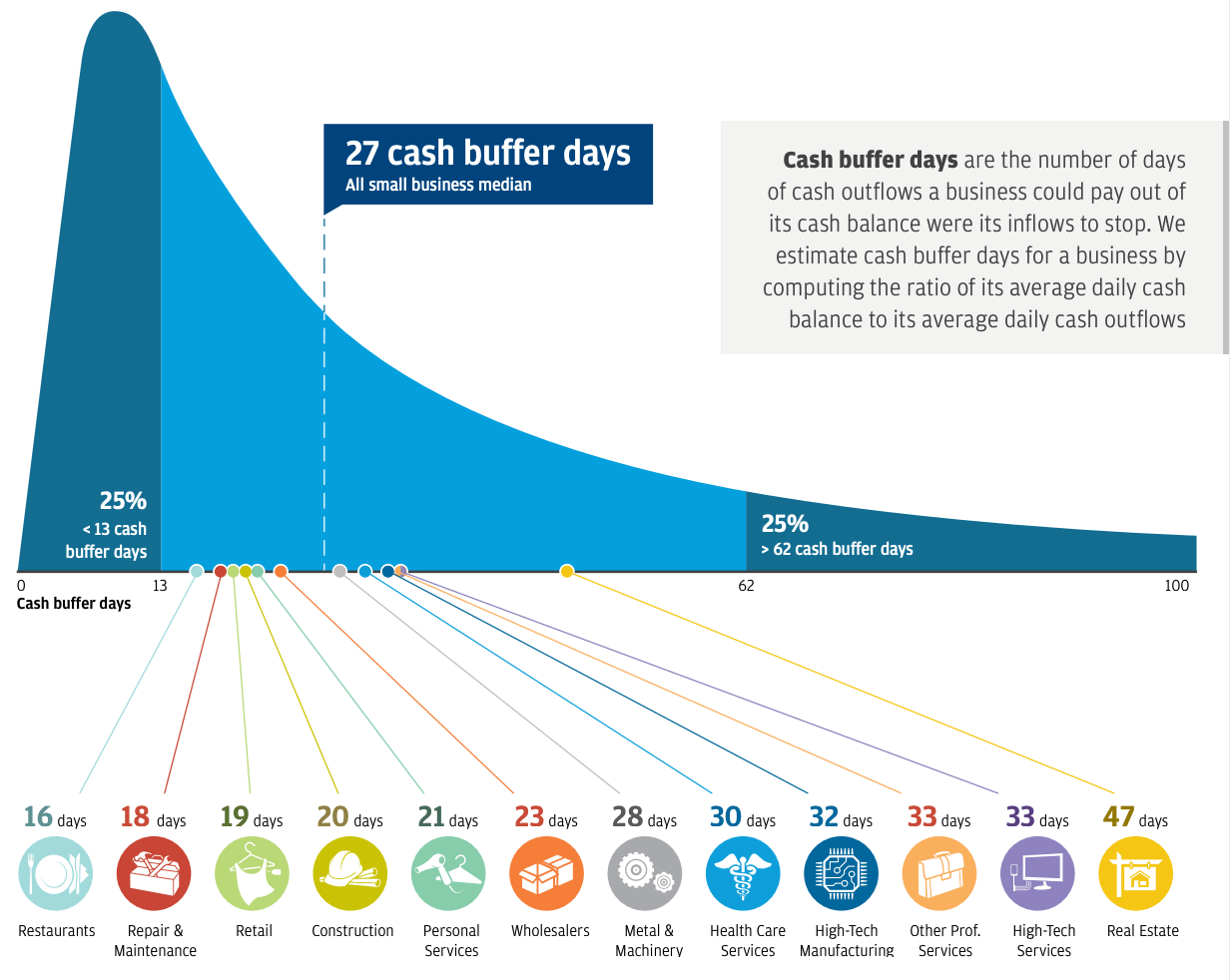

Based on a JP Morgan Chase study, SMEs manage to have an average of only 27 cash buffer days to cover their cash outflows if their cash inflows were to stop.

The avg. number of days a business could pay out of its cash balance if cash inflows were to stop.

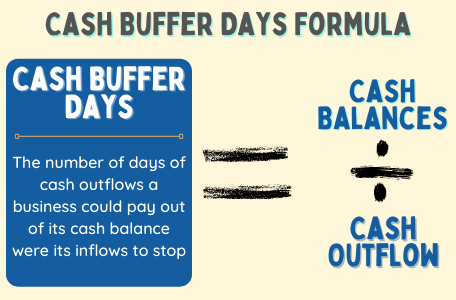

To find out how many cash buffer days your business has, use the below formula: Cash Balance divided by Cash Outflows equals to Cash Buffer Days.

Cash Buffer Days equals to cash balances divided by cash outflow

What’s more is that 47% of small businesses would need to resort to their personal funds were they to face a two-month loss. Also, 17% of whom say so, would need to close their business.

Insufficient cash reserves is a serious cash flow problem and businesses must learn to save cash to avoid bankruptcy after all cash adjustments have been made.

-

Inventory Overstock

It is always good to have extra inventory supply as a buffer to meet unexpected surges in demand. This is important for better inventory control that helps avoid stockout costs.

However, an overstock is a sign of poor inventory management and slow business growth.

Excessive inventory can slacken cash inflow and lower liquidity. This may leave the business with ample cash tied in tangible assets which could otherwise generate revenue.

Inventory management is particularly a problem for retail businesses whose products are tangible assets.

-

Urge for Rapid Business Growth

Who doesn’t want quick growth and expansion?

Oftentimes, the more you want to grow = the more you must spend to run a business.

This includes additional overhead costs, such as:

- hiring new employees

- increasing inventory investment

- improving technology and infrastructure

- outsourcing

Businesses often underestimate how growth affects cash flow.

B2B sales are often made on 30-90 days payment terms. As deals grow, the business has more sales tied in accounts receivables.

While companies wait 1-3 months to get paid, suppliers and other expenses must be paid either upon receipt or by month-end.

This causes cash flow problems to escalate quickly.

One must understand and manage financial and other business risks properly, or else it will be difficult to make ends meet with limited debt-paying ability.

What Causes Cash Flow Problems

Knowing you have a cash flow issue is a good starting point but not enough; one needs to identify the cause to solve the problem.

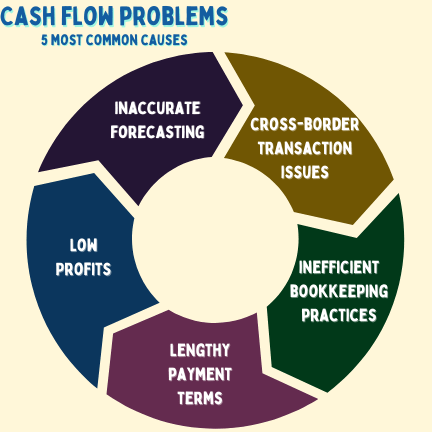

A greater problem is that while the issue is common, the cause is often uncertain. Complied below are 5 common causes of cash flow problems:

Common causes of Cash Flow Problems

-

Inaccurate Forecasting

Managing daily cash flows while communicating with multiple departments can be difficult.

Inaccurate forecasting is due to:

- Data and human errors as it takes time to validate and cross-check the information

- Uncertainty about the demand for the product or service the company provides

- Supply Chain Distressed information: client’s orders may get cancelled, increase, or be delayed due to logistics or shipping problems.

- Consolidating and inputting data from different sources can lead to errors and people often do not have the luxury of time to validate and cross-check this data.

A mere 45% of sellers have high confidence in their company’s forecasting accuracy.

-

Cross-Border Transaction Issues

Companies dealing with clients from different countries are exposed to cross-border payments and exchange risk.

Also, processing delays may occur depending on jurisdiction and bank used. For example, the currency settlement date may be 2-3 days later.

-

Lengthy Payment Terms

Offering long payment periods to clients is like shooting yourself in the foot. SMEs who are already low on capital find it more difficult to strive on such long payment terms. This can create inefficiencies in the cash flow cycle as an increasing amount of liquidity gets tied in capital. The time to convert inventory into cash will be longer.

Learn what is a good cash conversion cycle for your business and decide payment terms accordingly for your clients.

So, you may wonder: how long is a long payment term?

Well, it varies from business to business.

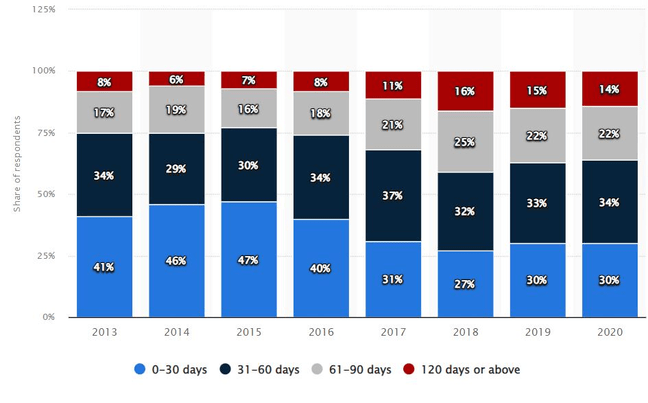

Share of payment terms in days offered by businesses, APAC region, 2013-2020

Majority of goods are sold on 31-60 days payment terms as seen above.

-

Inefficient Bookkeeping Practices

With numerous clients to deal with and multiple transactions happening simultaneously, it is possible for companies to miss recording a financial transaction or two.

SMEs who cannot afford to buy an accounting software are more likely to incur this problem.

Forgetting to record a payable and never actually getting paid for the goods or service you offered can cost you a lot in the future.

This reduces your cash inflow which resembles poor cash flow management and can therefore have a negative impact on your cash cycle.

-

Low Profits

This is commonly a problem for start-ups and SMEs who are still in their initial growth phase, establishing their brand. They have inadequate liquidity inflow due to low profits.

Starting with high price points is not a good solution either if they want to attract demand and establish a strong customer base. It is common for such companies to incur negative cash flow from investing activities.

The Home Depot Case Study

This Fortune 500 home repair retailer that was ranked 28th amongst the largest companies in the United States in 2016 was on the verge of bankruptcy in 1985.

The reason being? Its insanely high cash burn rate.

Home Depot was spending $4 million more per month to pay its suppliers, employees, and meet other operating expenses than the amount of cash earned from customers.

Additionally, it was spending $8 million to build and buy new stores from other companies.

This led to a total of $12 million cash burn rate per month!

By 1986, the company had a cash balance of $9 million, which would only sustain it for three weeks.

To make matters worse, the company had to repay $92 million of debt.

So,

- How could a company possibly come with a cash flow plan in three weeks?

- What did Home Depot do to turn things around?

Mostly focused on:

- Reducing its cash flow from operating expenses

- By implementing an inventory management system, it avoided unnecessary purchases and reduced idle assets in the warehouse. This saved it nearly $55 million!

- Collection of credit. The company also collected all its outstanding receivables which reduced its operating cycle from 122 days to 75 days.

As a result, this led Home Depot to:

- increase its profit margins

- reduce overhead expenses

- reduce operating cash flow

- reduce cash burnt rate significantly

This company is a classic example demonstrating the severe repercussions of poor cash flow management.

What matters is to understand the root cause and implement appropriate solutions to resolve these problems.

This is the real challenge.

Businesses must learn and apply the different ways to improve cash flow and attain a 360-degree understanding on their cash movements.

Also, further knowledge on what is cash flow management can help to gain a strategic understanding on how these measures could be implemented for maximum operational efficiency.