As international companies seek to reduce their reliance on a single source for their supply chain, Vietnam is emerging as a viable alternative for the world’s ever-increasing manufacturing needs.

With lower labour costs, proximity to China’s manufacturing hub, a skilled workforce, and technology advancements, Vietnam serves as a good source of diversification for global supply chains.

Highlights of this article:

- Adding to the Global Value Chain

Rising exports while shifting to a higher value-added manufacturing hub - Cost-Effective Manufacturing Hub

Low labour costs and strong geolocation enhance accessibility - Ease of Doing Business

Vietnam’s less red tape requirements make it perfect for relocating global supply chains - Opportunities in the Growing Vietnam Tech Sector

Vietnam’s tech-savvy labour fosters digital transformation partnerships

Content

In the wake of the latest global trade tensions, businesses have been shifting their supply chains from China to Vietnam. The country offers several benefits that make it a competitive sourcing hub.

Vietnam’s Presence in the Global Value Chain

Vietnam has many opportunities in front of it as it tries to move from simple assembly production to more complex, higher value-added manufacturing in global value chains (GVCs).

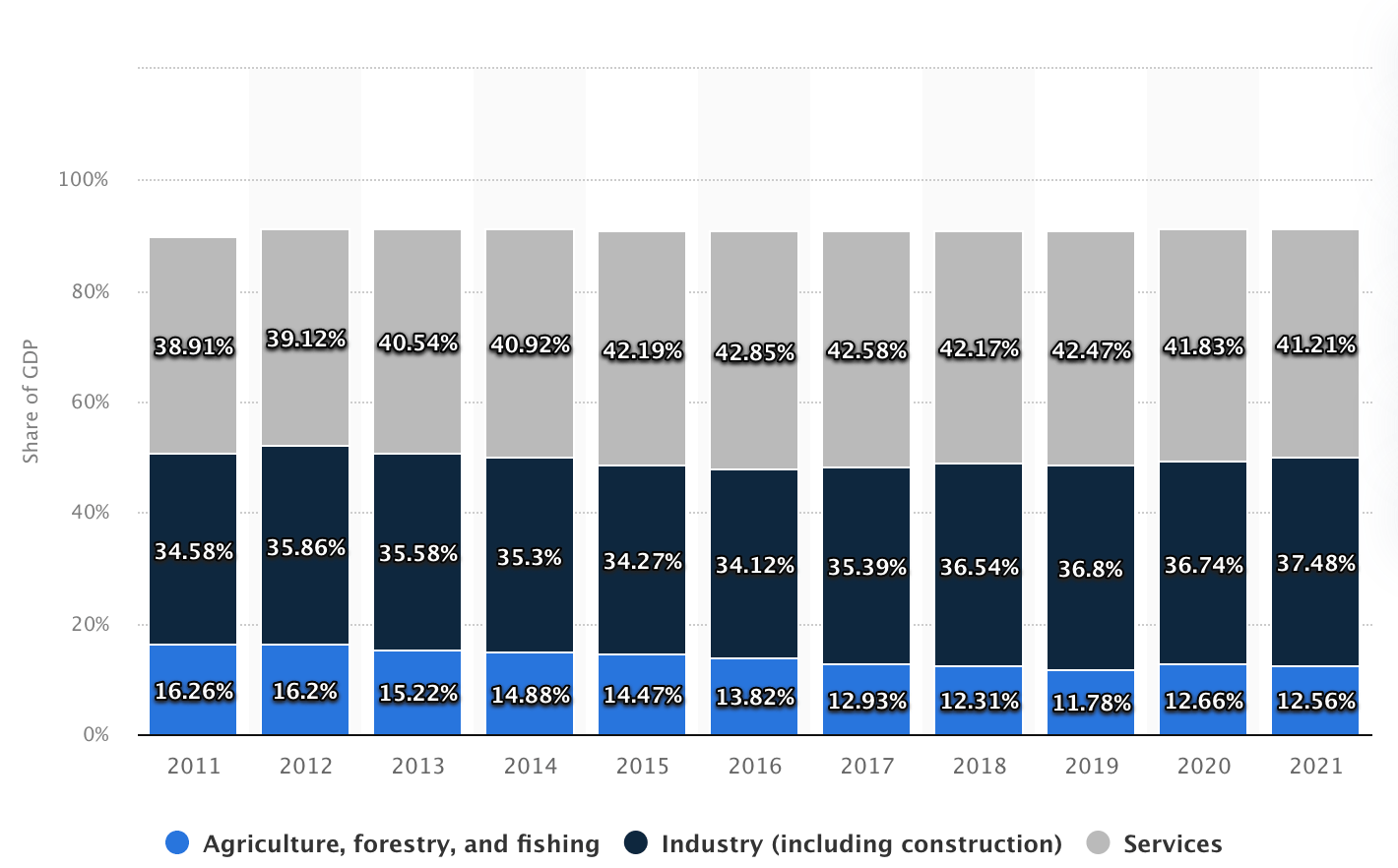

This can be witnessed with its shift in dominant import and export sectors. Until 2021 Vietnam’s gross domestic product (GDP) was mainly contributed by its service sector, which accounted for an average of 40% of GDP.

Vietnam GDP Distribution by Economic Sectors, 2011-2021, Statista

This sector involves producing intangible goods for both businesses and end users. Around 37.48% of the Vietnamese population works in the service sector.

However, the country’s recent shift in producing and trading electrical components and hardware products shows its growing technical expertise in producing complex products.

Some of its top primary imports now include:

- Integrated Circuits ($34.2B)

- Telephones ($16.5B)

- Semiconductor Devices ($6.04B)

- Light Rubberized Knitted Fabric ($4.84B)

- Broadcasting Accessories ($4.1B)

These goods are mainly sourced from China ($104B), South Korea ($48B), Japan ($16.1B), Chinese Taipei ($11.5B), and Thailand ($11.2B)

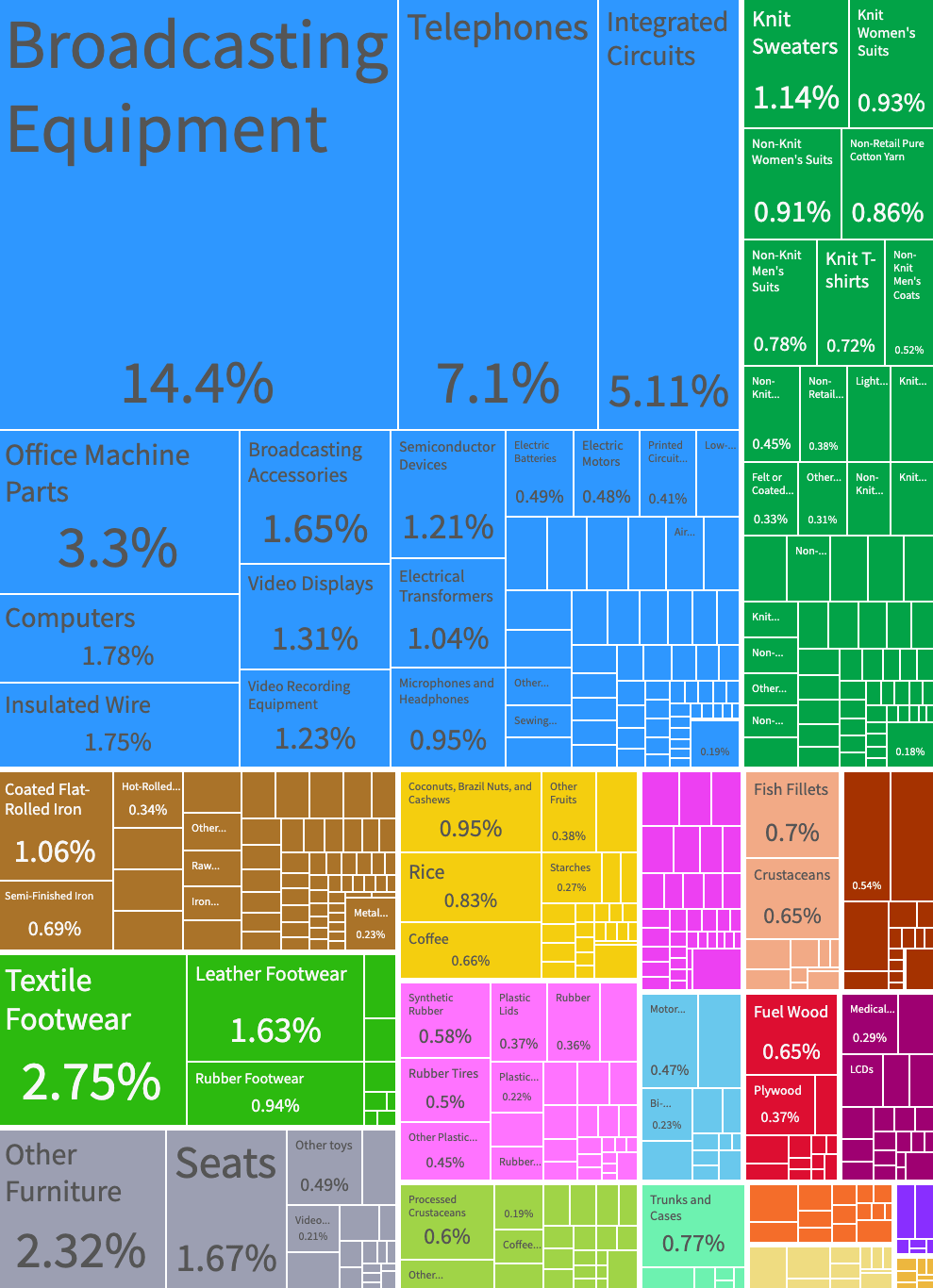

On the other hand, Vietnam’s top exports are:

- Broadcasting Equipment ($51.1B)

- Telephones ($25.3B)

- Integrated Circuits ($18.2B)

- Office Machine Parts ($11.7B)

- Textile Footwear ($9.79B)

Exports Distributions by Products, Vietnam, OEC, 2021

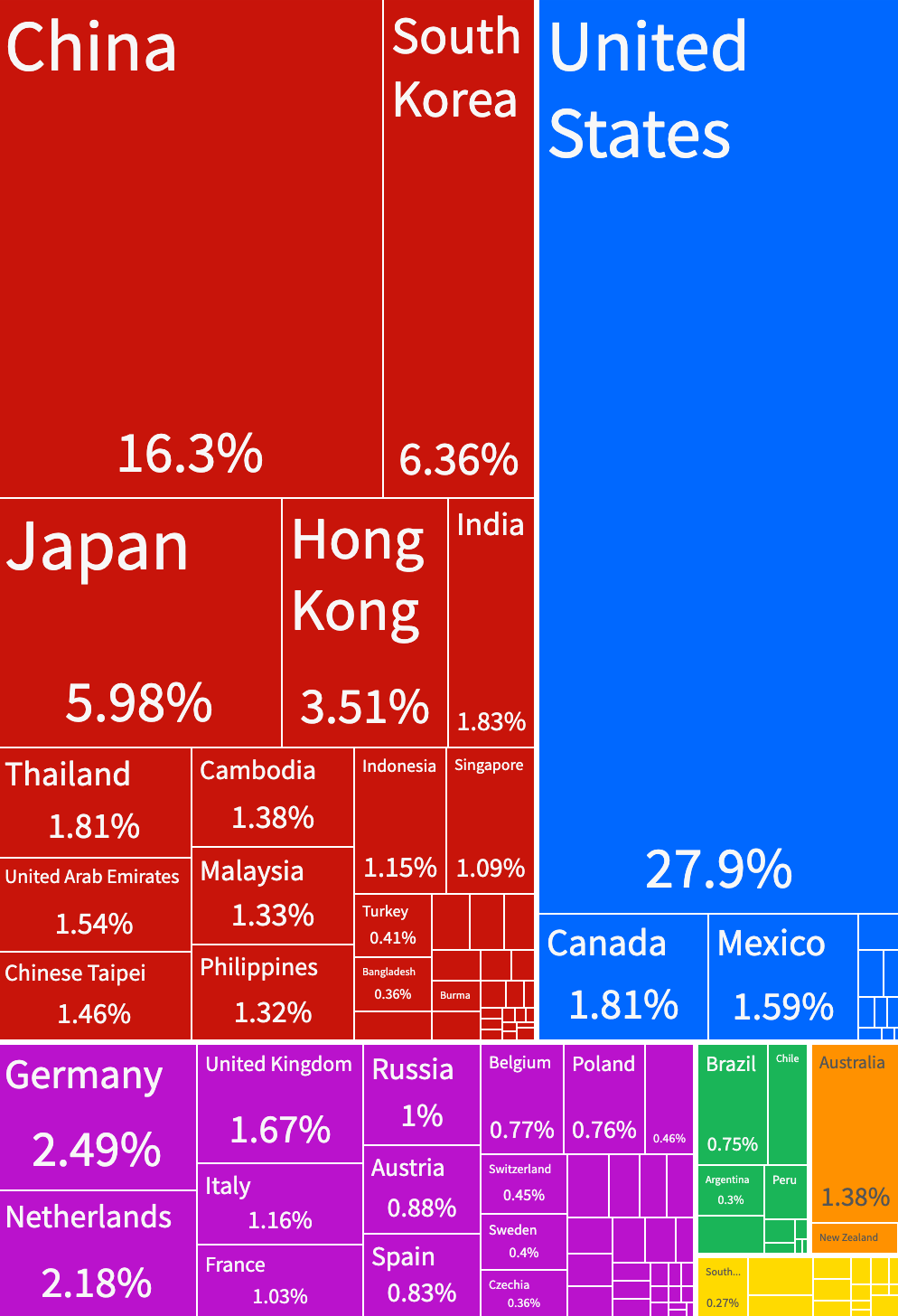

Most of these goods are primarily shipped to the United States ($77B), China ($49.4B), Japan ($20.4B), South Korea ($19.6B), and Hong Kong ($13.8B).

Exports Distributions by Country, Vietnam, OEC, 2021

An influx in component-based imports and more hardware-based exports can be seen. As Vietnam becomes more of a manufacturing hub, we can only expect these trends to continue.

Low Labour and Transport Costs

The country’s lower labour costs make it a profitable sourcing partner.

The average cost of hiring a factory employee in Vietnam is around one-third of that in China. This is particularly the case in factories near major cities where average salaries are approaching $30/day in China.

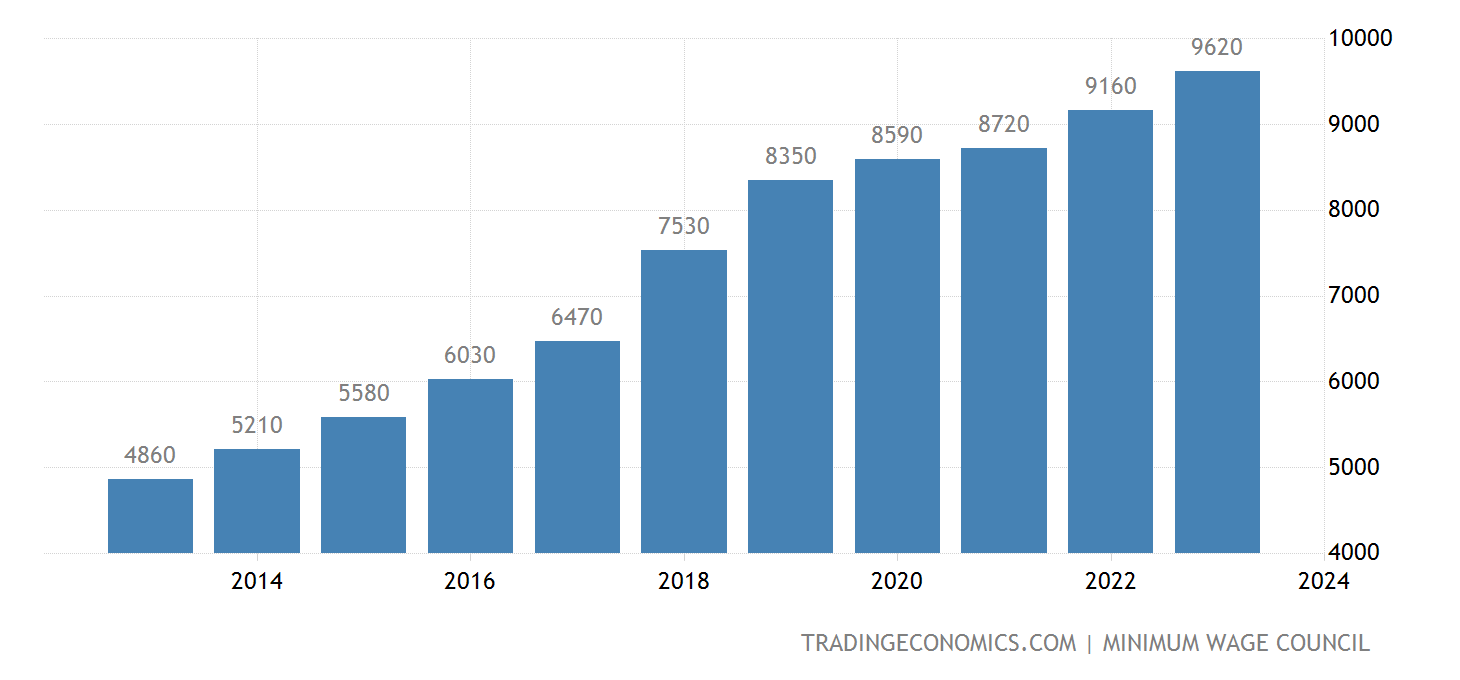

Likewise, minimum hourly wages in South Korea have been increasing and are forecasted to increase further in 2024.

South Korean Minimum Hourly Wages, 2013-2024, Trading Economics

Raw materials are essential to streamline production, and although China holds an edge in material sourcing, most materials are also available in Vietnam. Goods that are not are often imported from China.

However, the transport cost is relatively low.

Vietnam’s proximity to China’s manufacturing hub of Guangdong Province makes it a more cost-effective option for manufacturers. The delivery time can be as short as a day between the two countries.

The country does all this while maintaining identical output and quality.

Efficient Business Expansion

Vietnam’s investor-friendly government, less red tape and regulations for start-ups make it competitive with other manufacturing hubs.

The Chinese and South Korean governments particularly implement strict regulations on factories. Navigating their legal systems can be difficult for non-natives. In contrast, investors will find it easier to set up their factories in Vietnam, where the government offers perks and incentives for investors.

Strong fundamentals and proactive containment policies have led to a continued flow of foreign direct investment (FDI) to the economy, although at a lower level than pre-pandemic.

One study suggests that FDI inflows are a key factor behind Vietnam’s economic transition to manufacturing and stronger GVC participation over the years.

Vietnam’s participation in various bilateral and regional free trade agreements (FTAs) has also largely attracted investors. Its participation in the below trade agreements aside from the ones offered by the ASEAN membership, has positioned it as an international trade hub and a competitive player in the global market:

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

- EU-Vietnam FTA (EVFTA)

- UK-Vietnam FTA (UKVFTA)

- the upcoming Regional Comprehensive Economic Partnership (RCEP)

The country is thus further able to align with international standards when doing foreign business while reducing trade barriers. This helps it conform to labour standards while modernising labour laws and industrial relation systems.

To continue attracting FDI and enhancing its participation in GVCs, Vietnam must sustain efforts to improve business regulations and address structural constraints to take advantage of shifting GVCs and move up the value chain.

Highly Literate and Competent Workforce

Another competitive factor is Vietnam’s increasingly skilled labour and higher English competency than competing hubs like India.

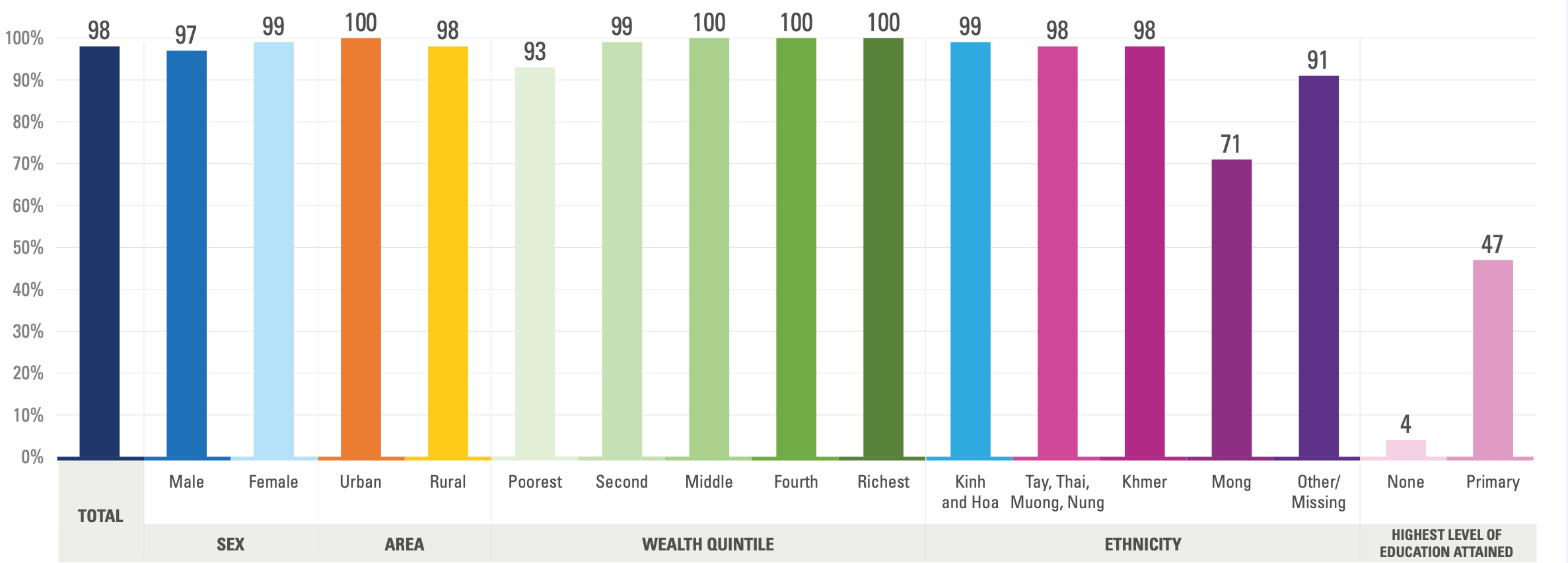

Vietnam’s youth aged 15-24 possess an average literacy rate of 98%, as per the latest Education Fact Sheet Report, compared to the world average of 87%.

The majority of Vietnam’s labour force is employed in the manufacturing, services, and agriculture sectors, which together account for 81% of the country’s GDP.

Young workers in Vietnam are moving away from traditional agriculture to the growing manufacturing and services industries, aided by the increasing mechanisation of agriculture.

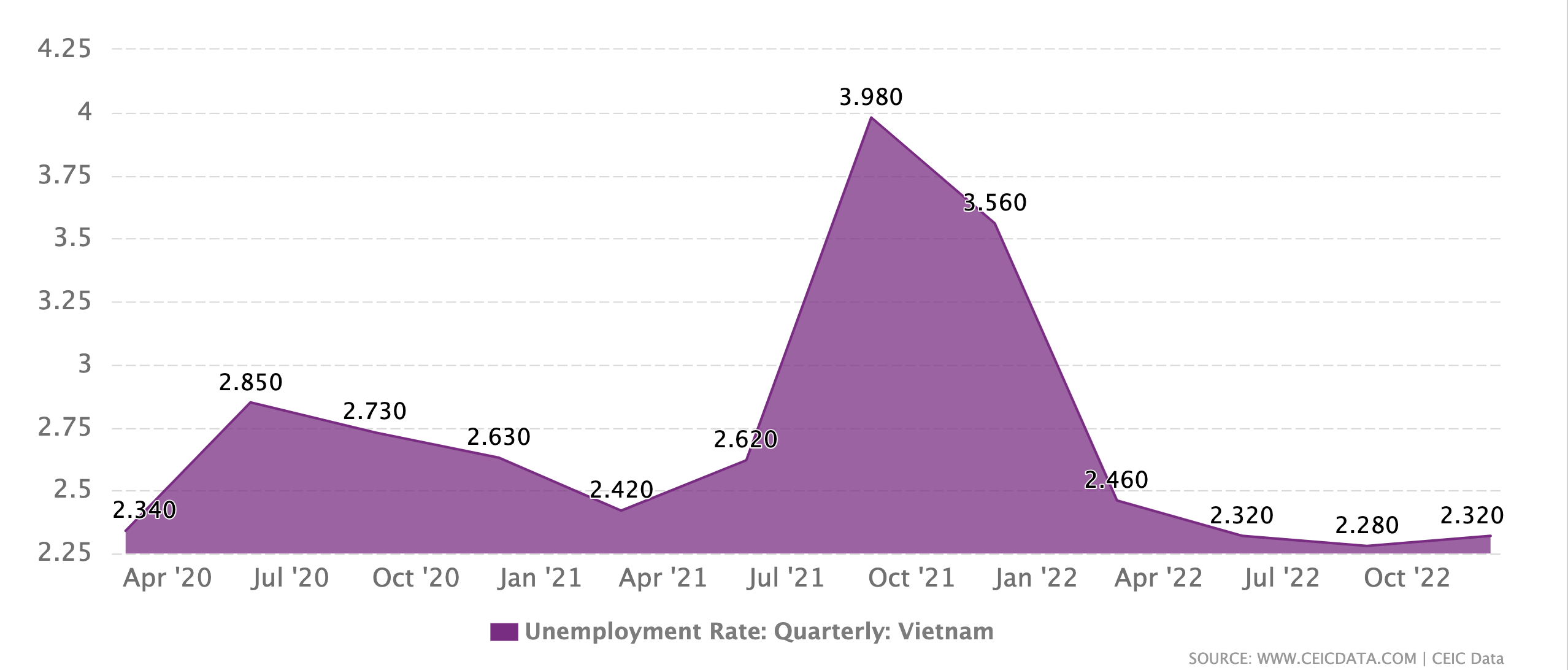

The country also reported a significantly lower unemployment rate of 2.32% by the end of 2022.

Vietnam Unemployment Rate, CEIC Data, 2020-2022

While only 11% of Vietnam’s domestic workforce is considered highly skilled, the government is focusing on vocational certificates and university education to develop the workforce.

According to Quyen Nguyen, co-founder of the Vietnam Supply Chain Association, investing more in cultivating a skilled workforce is crucial.

“Innovation is everything – it starts with education.” – Quyen Nguyen says

Opportunistic Market for the Electronics Industry

A major share of Vietnam’s growing economy goes to its technology sector. The increasing demand for IT services globally and the accelerated pace of digital transformation within the country are sure to grow the country’s economy in the short and long term.

The Vietnamese Ministry of Information and Communications has set a goal of having 100,000 digital firms in Vietnam by 2025 – an increase of 56.25% from 2021. This growth is also reflected in the software exports of domestic enterprises like the tech giant FPT. It earned 11.73 trillion VND (478.83 million USD) from exports by August 2022 – a year-on-year increase of 28.7%.

The push for digital transformation is not only being led by businesses but also by the public sector. Banks such as the Bank for Investment and Development of Vietnam (BIDV) and Vietnam Public Joint Stock Commercial Bank (PVcomBank) have implemented digital transformation projects with the help of tech group CMC.

Velotrade, being a financing institution, has worked with several Vietnamese companies exporting goods across the globe. We have helped several companies finance trades to expand their sourcing to Vietnam. Having established operations in Vietnam, we possess regional market expertise to support businesses in facilitating their imports and exports.

Want to expand your supply chain to Vietnam by leveraging technology? Reach out to us regarding your requests, and our sales expert from Vietnam will get in touch!

Like our content? Follow us!